What is AEON Credit Service Philippines Inc?

AEON Credit Service Philippines Inc. is a lending company that specializes in short-term loans for consumers. Established in 2013, AEON started offering installment options for consumer products.

Those who want to purchase home appliances, electronic products, and furniture can do so in easy installments. AEON also offers personal loans, which is a great way to get the money you need without having to go through a traditional bank.

AEON Credit, how does it work?

If you want to avail of an appliance, furniture, or gadget loan, you can visit any of the 5,000 Aeon partner stores and approach the sales promoters. You only need to present two valid IDs and your loan application will be processed. Alternatively, you can apply for a loan using the AEON mobile app.

Cash loans are only offered to borrowers who have already completed paying off a previous loan and have good credit standing with AEON. However, if you live in San Fernando, Pampanga, Legazpi City, Albay, Metro Cebu, and Davao City, you can apply for a cash loan even without a prior completed loan account with AEON.

If you have previously completed an AEON Installment Plan, you will be given an AEON Retention Code via SMS on your registered mobile number. You will need this retention code to proceed to your AEON cash loan application via the app.

How much does AEON Credit loans?

With an AEON Credit cash loan, you can borrow from P6,000 to P150,000. However, the cash loan amount that will be approved is based on your salary. The interest rate for AEON Credit personal loan is 2% per month. The AEON credit installment loan term is anywhere from 6 to 12 months. Keep in mind that there is a P1,000 processing fee on top of the loan amount and interest.

For non-cash loan, the company approves the price of the appliances, gadgets, furniture, or other consumer products. The interest rate for non-cash loans is from 0.85% and the loan term is 180 to 720 days to pay the amount.

AEON Credit cash loan, how to apply?

AEON Credit is a cash loan provider that offers fast, easy, and convenient loans. You can apply for AEON Credit online or in-person. For online applications, you have to download the AEON Credit app from the Google Play Store.

The application process is simple and takes only a few minutes to complete. You just need to fill out an application form and submit the required supporting documents.

Once you have submitted your application, you will be contacted by an AEON Credit personal loan officer to discuss your loan options. If your loan is approved, you will receive a text or SMS to notify you that you can receive the money on your chosen option.

AEON Credit Requirements

-

You must be a Filipino citizen with a Philippine address.

-

You must be 18 to 60 years old.

-

You must be currently employed for at least 6 months, self-employed, or a beneficiary of remittances from a relative.

-

You must have a valid contact number (mobile, landline)

-

You must have an e-mail address.

For employed borrowers, you are required to submit 2 valid government-issued IDs.

For self-employed borrowers. Your business must have been operating for at least one year. You have to submit the following requirements:

-

2 valid IDs

-

Proof of billing

-

Proof of income

-

DTI or Mayor’s Permit

For beneficiary borrowers, you must submit the following:

-

2 valid IDs

-

Proof of billing

-

Proof of income

Beneficiary refers to those who receive remittance from relatives abroad. You must be legally related to the person sending you the remittance.

How long does it take to have the money?

The AEON Credit loan application process takes 1 to 3 days. Expect an AEON representative to call you to verify that you are who you claim to be. Once you’re approved for the AEON Credit loan, you’ll be able to receive the loan amount by visiting the AEON office to collect the money via check.

AEON Credit installment, how to pay the loan?

To pay your loan, you must have your 10-digit AEON Personal Loan Agreement Number, which will be given to you upon the approval of your loan application.

You can pay your AEON cash loan through various accredited payment partners:

-

7-11

-

Bayad Center

-

Cebuana Lhuillier

-

M Lhuillier

-

SM Bills Pay

-

ECPay

-

LBC

-

Villarica

-

True Money

-

All Day

-

CVM

-

ExpressPay

-

PeraHub

-

TouchPay

-

USSC

-

Puregold

You can also pay online through GCash and PayMaya. You need to download the app, go to Bills Payment and select AEON Credit. Enter the agreement number and the amount.

What happens if I can't pay?

If you are not able to pay your loan installment on time, you may be charged a late payment fee by AEON. So, it is important to keep track of when you are supposed to make each payment. If you miss a payment, AEON may also decide to convert that debt into a higher interest rate. When you default on your loan, AEON may take legal action as a last resort. In any case, expect repeated calls to

Is AEON Credit legit? Is it SEC registered?

Yes. AEON Credit Philippines is a legit company registered with the Securities and Exchange Commission on February 14, 2013. It has a Certificate of Authority to operate as a lending company in the Philippines.

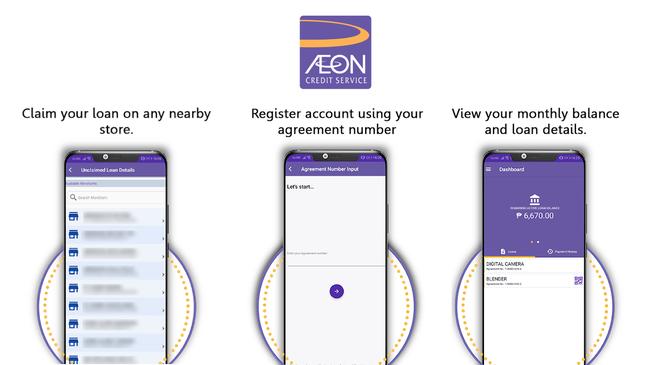

AEON Credit App

The AEON Credit loan app works on Android phones and it can be downloaded from the Google Play Store. The app is not available for the iPhone at this time. It’s designed for mobile phone and cannot be downloaded on desktops and laptops.

Website

For more information about AEON’s cash loan, visit the official AEON Credit website at https://www.aeonphilippines.com.ph .

AEON Credit, customer service

- AEON Credit Email address: customercare@aeonphilippines.com.ph

Phone number:

- Manila Office: +63 (02) 8631-1399

- Cebu Office: +63 (032) 3287-000

- Davao Office: +63 (082) 5537-788

- Pampanga Office: +63 (045) 8403-9732

- Legazpi Office: +63 (02) 8631-1399

Branches: AEON has branches in Manila, Cebu, and Davao. It also has satellite offices in Pampanga and Legazpi.

AEON Credit Service complaints

Majority of the complaints against AEON Credit are about its poor customer service. Borrowers complain about loan officers not responding to inquiries in a timely manner, or at all. Other complaints pertain to payment reminders being sent even though the loan has already been paid off. This creates a problem for borrowers because of the late payment fees and interest rates.

AEON Credit Service (Philippines) Inc, reviews

AEON Credit has an average rating of 3.7 stars at the Google Play Store. Many users of the app complain about the app always crashing or not working, making it difficult to apply for a loan. Aside from tech issues, many borrowers of AEON complain about how hard it is to contact loan officers.

Perhaps the biggest issue with AEON is the lack of updates and the failure to provide a certificate of full payment. Apparently, according to some borrowers, AEON continues to demand for payment even if the loan has been fully paid.

Have you used the AEON Credit Service loan? Share your experience here.