What is BillEase?

In BillEase, credit can be part of your financial power. You can shop at any store – or with their partnered merchants, without worrying about bills or the methods to pay it. BillEase is popular because they are a flagship product of FDFC (a financial technology company that is recognized for building innovative products in terms of retail credit in Southeast Asia.

BillEase Cash Loan and how does it work

A BillEash Cash Loan is cash received by the borrower. BillEase lets you enter into a short-term personal installment loan that you can use to cover unexpected expenses or needs. In general, BillEase doesn’t care about how you spend the money, as long as you are willing to pay it on time. It works by opening an account, submitting requirements, and the amount you want to see on your initial credit limit.

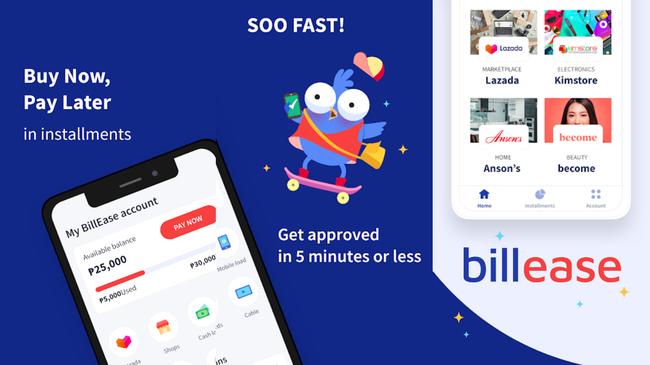

What is buy now and pay later?

BillEase also offers Buy Now, Pay Later. The latter allows BillEase users to make a purchase at a certain retailer, make a small down payment (calculated through the overall purchase amount), and then the remaining amount can be paid by installment or later regarding the agreement.

How much is BillEase Loan?

BillEase lets you borrow loans going from ₱2,000 up to 40,000 pesos with installments going from 1 month up to 12 month. You can use the money for online shopping even if you don’t own a credit card.

Interest rate

BillEase charges the lowest interest rate which is only 3.49% monthly. The borrower also has a payback option between 30 days to 12 months.

Credit limit

BillEase loans can go up to ₱40,000. As well, the installments can go up to 24 months in case of repeat customers.

Is BillEase legit and SEC-registered?

BillEase is legit and is regulated under the Securities and Exchange Commission (CoA No.:1101). They are also certified by the Bangko Sentral ng Pilipinas as an authentic Operator System. BillEase also builds the trust of its customers by being seen on many news affairs like The Manila Times, Philippine Star, BusinessMirror, and FinTech Singapore.

How long does it take to claim the loaned money?

Once you opened an account, submitted the necessary requirements, got approved, and set your initial credit limit, you can claim your borrowed money just within one (1) banking day. The word on the street says 70% of new BillEase users get approved on the spot.

BillEase Benefits

- In BillEase you can avail 0% APR on selected merchants if you opened an account today.

- BillEase is recognized for its flexible credit line.

- You can use an amount of 40,000 and below on any partnered or merchants of your choice.

- And as you become a long consumer of BillEase, you can unlock different features like e-Wallet top-ups, mobile loads, and even bills payment using your credit limit from BillEase!

BillEase vs Tendopay

The main diference between these 2 companies is that BillEase offers lower interest rates as compared to Tendopay which presents 5% of loan interest.

How to Apply for BillEase Cash Loan?

Follow the preceding steps to know how you can apply for a cash loan in BillEase:

- Download and Install the BillEase mobile app.

- Register to create an account and fill out all the necessary details.

- Wait for the six-digit confirmation code that will be sent to the email address you provided.

- Create a digital pin, provide valid IDs, and take a selfie right on the app.

Once you provided all the necessary requirements, wait for your initial credit limit (which usually takes one banking day).

- Now that you have the money, you can now use it to purchase products on Lazada or any BillEase Merchant partners.

Requirements

- Email address and phone number.

- A smartphone with a camera app to take a selfie for verification.

- Valid IDs such as: any government-issued ID like Driver’s License, passport, PRC ID, SSS Card, TIN ID, and NBI Clearance among others.

Loan calculator

As a useful tip the BillEase App has a loan calculator. This is to know the amount you have to pay back considering the number of monthly installments you chose.

How do you get a second loan?

You can also get a second loan if you successfully followed all the terms & conditions of the initial loan. Thus, giving you a high chance to get approved for a second loan.

How to pay BillEase Installment?

You can pay your installments via direct bank (online or not), e-wallets such as GCash or PayPal, 7-Eleven, or any of the 22,000 over-the-counter payment channels of BillEase.

What happens if I can't pay?

In case you forgot to pay your monthly installment, your chances of being approved for a second loan in BillEase will decrease. They also charge a 50 pesos penalty for every day that a customer imposed on missed payments.

BillEase partner stores

Some of the many partner stores of BillEase are:

- Lazada

- Kimstore

- Shopee

- Data Blitz

- Havaianas

- Samsung

- Motivo

- Banila Co

- And many more.

You can visit https://billease.ph/shops/ to find the merchant you prefer.

BillEase app

BillEase loves to make sure that they are dealing with the same person who owns the account. That’s why every login, make sure that the details match. Don’t forget to read all terms & conditions whenever you are applying for a loan too.

You can download the BillEase app from the next links:

- Download the BillEase app from the Google Play Store here.

- Download the BillEase app from the Apple App Store here.

BillEase login steps

To log in follow the next easy steps:

- Just open the BillEase app.

- Enter the mobile number or email address you provided.

- Include the password as well.

From BillEase to Gcash

Currently, the new feature of the BillEase app is the Gcash top-up. You can do this by clicking the “top-ups” button below and choosing the amount you want to put on your Gcash account. Once done, select your preferred installment and click ‘done’. Now, you can enjoy BillEase to Gcash!

BillEase Phone and Contact

You can contact BillEase through their phone numbers:

- Globe: +639159039339

- Smart: +639999804333.

You may also email them via info@billease.ph . Just keep in mind that their banking hours are from 9 am to 6 pm.

BillEase Review

There are lots of people who are fond of BillEase because it provides hassle-free transactions when shopping or paying bills. The loan experience is also fast – making BillEase recognized as “a loan to the rescue”. Some people say it is highly recommended, especially for those who are currently experiencing financial draught.

Have you used BillEase? Share your experience here.