What is Cash Me PH?

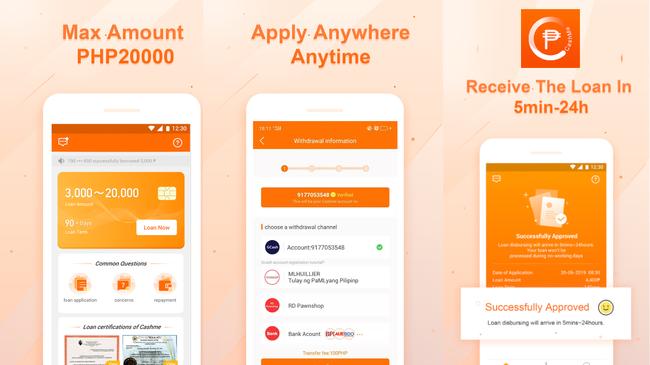

Cash Me PH or short for Cash Me is a trusted online lending platform in the Philippines. It is developed by Hupang Lending Technology Inc., which aims to provide hassle-free, convenient, and fast loans through the use of a mobile phone. The goal is to provide Filipinos with financial freedom.

The online lending platform Cash Me was launched in 2016 and is still operating up to date. This only proves its stability and reliability. Cash Me also understands that in the financial industry, customers are the center of it. And they delivered the product well by skipping the long lines, and instead, they can apply for a loan anywhere in the country as long as they have the app.

Cash Me Loan App, how does it work?

Here are the guidelines on how you can utilize the Cash Me loan application:

- Ensure that you have a stable internet connection to download the app

- Go to Google play store and search for “Cash Me” or click this link .

- Cash Me is also available on the App store, just find the Apple logo on Cash Me’s official website to download.

- Open the app to create an account. If you already have an existing account, you can directly log in.

- Fill out the information needed in the application.

- Review then submit.

Interest Rate

The interest rate for Cash Me loans ranges from 0.08% up to 1% per day depending on the loan amount and terms. The minimum loanable amount is PHP 2,000 and PHP 12,000 is the maximum. The loan is payable from 91 to 180 days.

Is Cash Me legit?

According to many borrowers’ testimony, Cash Me is a legitimate and trusted online lending platform that extends help to Filipinos who are in need financially. The name of the application can also be found on the SEC website under the section of Lending Companies and Financing companies. Having a certification from the government means this is a legal entity.

How much is the Cash Me loan?

Cash Me lending offers Filipinos a wide range of loans starting from PHP 2,000 which is usually higher than other lending companies’ minimum amount. The maximum loan amount is PHP 12,000.

For first-timers, expect that you cannot borrow up to the maximum amount since it requires a good credit score to borrow a larger amount. For repeat borrowers, there is a high chance that you can get a higher amount depending on your previous loan transaction.

Is Cash Me SEC-registered?

Cash Me PH or Cash Me is recognized by the Securities and Exchange Commission, the governing body tasked to provide businesses license to operate upon completion of requirements.

Cash Me is registered under its parent company, Hupan Lending Technology Inc., with Registration No. CS201901197 and Certificate of Authority No. 2879. To check out more information about Cash Me on the SEC’s official website, you can click here .

Cash Me loan app benefits

Here are some of the benefits you can get once you borrowed from Cash Me:

- Fast loan application approval

- Direct and easy mobile loan application

- Real-time tracking of the loan through the app

- Given personal information is safe and secured

- Accessible loan payment channels

Cash Me loan, how to apply?

Here’s how you can apply for a loan in Cash Me, whether it is your first time borrowing or not:

- Download the application on Google Play Store or Apple App Store, the link can also be found on Cash Me’s website https://www.cashme.ph/ for easy access.

- Create and register an account with your mobile number.

- Fill up the necessary information

- Choose your loan amount, payment terms, and outlet where you will get your cash.

- Review your application, then proceed to submit it.

- Wait for a confirmation and notice when your loan is approved and cash is ready for claiming.

Requirements

To ensure that you can secure a loan with Cash Me, here are the company’s basic requirements:

-

Must be a Filipino citizen

-

Age must be 18 to 60 years’ old

-

Has a government-issued ID (Driver’s license, Passport, Postal ID, PRC ID, Voter’s ID, etc.)

-

Income must be stable

Cash Me loan, how to pay?

After successfully acquiring a loan in Cash Me, maintain your good credit score by paying on time through the following payment channels:

-

GCash wallet

-

Online banking

-

7-Eleven payment kiosk

-

M Lhuillier

What happens if you can't pay?

There will be corresponding surcharges (interest and penalty) if you can’t pay on time. Failure to pay will also reflect a back credit rating on your account, making it hard to borrow the next time around.

How to pay Cash Me loan in Gcash?

As of today, there is no specific instruction or guidelines on how to pay Cash Me loan via GCash.

Cash Me Loan App

Using your mobile phone, search for “Cash Me” on the Google play store for android users and App Store for Apple/iPhone users to download the application.

App download

To download the app, visit your corresponding application store or visit Cash Me's official website at https://www.cashme.ph/ and find the link to download the application directly.

Cash Me, customer service

For more information and inquiries about Cash Me loan products, you may contact them at the following channels:

-

Email: cs@cashme.ph

-

Facebook: CashMePhilippines or visit the link

Hotline

-

Smart/TNT: 09190798587

-

TM/Globe: 09265923500

Cash Me, complaints and harassment

Before proceeding to borrow from Cash Me, you might want to check out the complaints they received from the customers. Here are some of the common complaints they received:

- There is a delay in the reflection of payment

- High-interest rates for a small amount of loan

- The amount received is not the same as the one borrowed

- Agents are harassing customers and forcing them to pay for the loan

- There is a breach of privacy

Cash Me, reviews

Despite the complaints and issues, Cash Me is receiving, the number of good reviews still outnumber the bad ones. Throughout their operation, they have helped and touched the hearts of Filipinos who badly needed financial help. Overall, Cash Me is a good lending platform. Just remember to borrow within your means.

Have you used the Cash Me loan? Share your experience here.