What is Cashalo?

Cashalo is a fintech solution, providing all-digital services to Filipinos in need. The name Cashalo is a combination of the words “Cash and Kasalo”. All loans under the Cashalo app or platform are financed by Paloo Financing Inc.

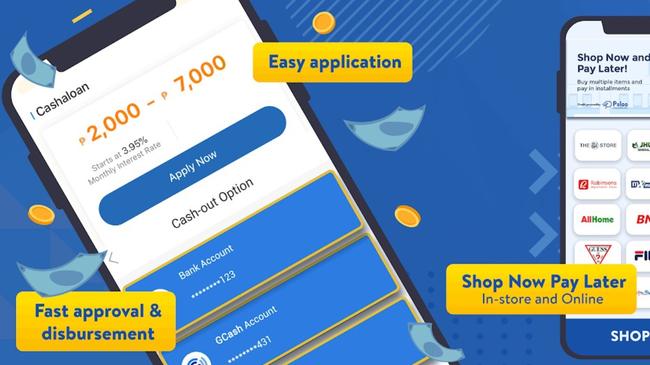

As a lending platform, it aims to uplift the well-being of the people by providing affordable and low-interest loans. Through the Cashalo app, clients can access an easy, fast, and safe solution to almost any money problem.

The good thing about Cashalo lending is that no collateral is needed to apply for a loan. This means that you can borrow money in no time, you just need to download the app or visit their official website to start your application.

How does Cashalo work?

Cashalo is widely known for being a financial lending institution, it also offers a “buy now, pay later” scheme to clients where you can purchase on an authorized shopping application like Shopee and Lazada. When it comes to borrowing, Cashalo offers clients free of any processing fee, a 3-month loan installment, and has fast approvals.

You can access and explore more about Cashalo on their official website https://cashalo.com/ or download the Cashalo application on Google play store and Apple app store to know more about their loan offerings such as the Cash Loan, Lazada Loan, and Buy Now Pay Later products.

How can I apply for a loan with Cashalo?

To start your cash loan application with Cashalo, visit Cashalo’s official website https://cashalo.com/ or download their application on Google play store and Apple app store and just follow these 6 easy steps:

- Register with your mobile number.

- Click the “Apply Now” button for a cash loan.

- Fill up your profile information.

- Choose your preferred loan amount and terms.

- Select for the cash-out preference (Bank, GCash, or PayMaya).

- Wait for approval after completing the application.

Requirements

-

Must be 18 years old and above

-

A Filipino citizen

-

Personal information (Government-issued ID & Proof of billing)

-

Work information (Work ID & Recent payslip)

-

Preferred bank account details

How much does Cashalo loan?

The minimum loanable amount for Cashalo first-time borrowers is less than Php 1,500 and for the repeat or continuous borrower, the amount can range from Php 2,000 up to Php 10,000. The first loan should be paid within the period of 45 days or less.

Note that the repayment terms may vary depending on the preference of the client.

Interest Rate

-

There is a 10% interest per month for the first loan

-

The annual interest for borrowing is not more than 49.68%

For accurate amounts, visit the Cashalo online calculator.

How much is the first loan in Cashalo?

You can avail of up to Php 1,500 on your first loan with Cashalo. The loan comes with a 10% monthly interest.

How to pay Cashalo loan?

When it comes to authorized repayment outlets, there is nothing to worry about because Cashalo has many partner merchants you can choose from:

-

Online payment via E-wallet (Gcash, PayMaya, Shopee Pay)

-

Over-the-counter payment (7-Eleven, Bayad Center, SM Business Center, Robinsons Business Center)

-

Online banking (BPI, Robinsons Bank, BDO, Cashalo Website)

-

Remittance and Payment centers (Cebuana Lhuillier, LBC, Touchpay)

Cashalo Loan Payment Terms

Cashalo provides different loan payment terms depending on the preference of the client. But usually, it ranges from less than 45 days up to one year depending on the loan product the client availed.

What can happen with a Cashalo unpaid loan?

There are numerous unpleasant things when you don’t pay for your loan. Here are the possible consequences if you experience default loan payments:

-

There will be additional charges and interests

-

The bank will frequently call you

-

Your credit score will eventually drop

-

If there are any, your collateral will be subject to repossession

-

The bank has the power to seize your savings account

-

Worst case, you will be facing lawsuits

Remember to avoid default payments, make sure to borrow the amount you can afford to pay.

Is Cashalo legit?

The answer is yes. Cashalo is a legitimate online lending platform registered and operated in the Philippines. No business can operate in the country without undergoing legal processes.

Cashalo is registered in the SEC (Securities and Exchange Commission) with a registration number of CSC201800209. The company’s certificate of authority number is 1162. This information supports that Cashalo is legit, and you can be at ease that your information is safe with them.

Cashalo Application

Cashalo application is free and can be downloaded by anyone. You just need a good internet connection and a mobile phone. Cashalo app can be downloaded on both the Google play store and the Apple app store.

-

For Google play store, click https://play.google.com/store/apps/details?id=com.oriente.cashalo

-

For the Apple app store, click https://apps.apple.com/ph/app/cashalo-cash-loan-and-credit/id1346512953

After downloading, you just need to enter your mobile number or Facebook account to register.

Cashalo Customer Service

To those clients who are having issues or has queries regarding their loan application and repayments, you can reach Cashalo customer service via this channels:

Phone Number

-

(02) 8470-6888

-

0908-880-4642 (Smart)

-

0917-185-0178 (Globe)

E-mail Address

Cashalo customer service is open from 9:00 AM to 8:00 PM (Weekdays) and 9:00 AM to 6:00 PM (Weekends).

Cashalo Complaints

When it comes to customer complaints, here are some of the most common issues encountered by clients when using Cashalo:

-

Loan rejection for repeat/second loan application

-

There are issues when it comes to using the application (e.g. automatic log out)

-

Data privacy issues, some complains they are receiving are messages from other lending company

-

Repayment issues (delay reflection of payment, failed disbursement)

Cashalo Reviews

Here are some of the reviews given by clients, in their first-time and repeat loans with Cashalo:

- Fast and easy loan approval even for first-timers

- The application is very useful, though the app requires too many documents to verify and process the loan

- Very good customer service and easily addresses issues

- Detailed calculation of interest rate plus they really offer low interest rates compared to other lending company

- There is no issue when submitting loans, and they provide options in terms of failure to repay the loan

Have you used the Cashalo loans? Share your experience here.