What is CashCow?

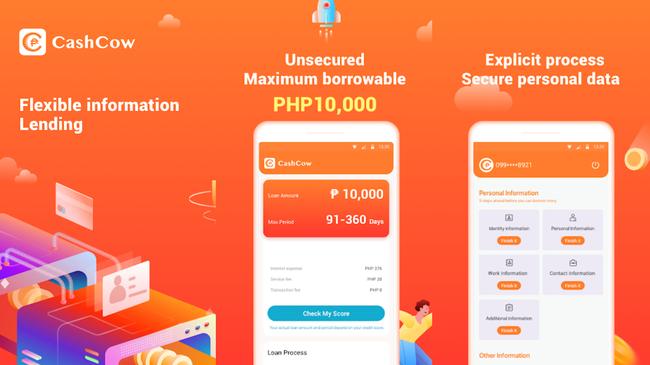

CashCow is an online lending application that allows Filipinos to borrow money completely online. The loan application process is quick and easy through the CashCow app. It does not require credit checks, paperwork, or collateral. This is great for people who may not have good credit or who don't have assets to put up collateral.

CashCow has a strong commitment to transparency and provides detailed information about the loan, including interest rate, repayment schedule, and other terms and conditions, so that borrowers can make an informed decision on whether or not to avail of the cash loan.

CashCow loan, how does it work?

To apply for a cash loan, you must first download the app from the Google Play Store. Currently, the CashCow app only works on Android phones. It’s not available for the iPhone. After downloading the app, you have to create an account.

Once registered, you’ll have access to the loan application. You just have to indicate the loan amount you wish to borrow and the details of the loan will be displayed, including the loan term, interest, service fee, and transaction fee.

You can then proceed and fill out the application form and provide personal information, work details, IDs, contact numbers, and other information. CashCow will evaluate your application. Once approved, CashCow will release the funds to your chosen bank.

How much does CashCow loans?

The maximum loan amount you can borrow from CashCow is P10,000 with an interest rate of 10.8% per year (Annual Percentage Rate). There is also a service fee of 0.2%. The loan repayment term is anywhere from 91 to 360 days.

Keep in mind that you’re not likely to get the maximum loan amount on your first loan application. However, if you have paid off a previous loan and you have good credit standing, you’re likely to get a bigger loan amount.

Is CashCow legit? Is SEC registered?

Yes. CashCow is a legit lending app. It is operated by a company called Fast Coin Lending Corporation, which is registered with the Securities and Exchange Commission. It has a Certificate of Authority to operate as a lending company.

How long does it take to have the money?

Upon approval of your loan application, CashCow will release the money within 24 hours to your selected bank or payment channel. If the approval falls on a weekend or on a holiday, expect to receive the money on the next business day.

CashCow, how to apply for a loan?

To apply for a loan, you must create an account on the CashCow app. Just fill out the application form and submit valid IDs and supporting documents. CashCow will review your application and approve it if you meet all the requirements.

Requirements

-

You must be at least 18 years old.

-

You must have valid IDs.

-

You must have a mobile phone.

How do I pay the CashCow loan?

You can pay your CashCow cash loan online or offline through accredited payment channels. Make sure to pay on time to avoid penalty charges such as overdue payment charges, higher interest rates, and administrative fees.

What happens if I can't pay?

If you're unable to pay back your loan from CashCow, you can expect collectors to contact you often. It’s highly possible that they will resort to aggressive debt collection techniques to force you to pay. As a last resort, the company can take legal action against you.

CashCow app

The loan application process all happens in the CashCow app, which you can download from the Google Play Store. With its simple design, using the app is pretty straightforward and intuitive. It’s easy to use and the loan application is done in minutes. When all the necessary documents are submitted, CashCow will review the application and either approve or deny it.

CashCow customer service

You can contact CashCow customer service via text and email.

- Phone number: +63 966 2095943

- Email address: jovenchen2020@gmail.com

CashCow complaints

Even though CashCow is a legit company and appears to be a useful app to get access to quick cash in times of emergency, it’s not without its problems. There have been many complaints about the extremely high interest rates and fees on the loans.

Customers feel taken advantage of. For example, one customer said they were charged more than the listed interest rate of 10.8% APR. The interest can reach more than 40%, which really leaves little cash left for borrowers to use. Moreover, the loan term is fixed at 7 days instead of the listed 91 to 360 days.

In general, customers complain about not receiving what was promised in terms of interest rates and repayment terms and feeling like they're being pressured to accept loans that are more than they can afford.

Another major complaint is the very aggressive way in which loan officers collect payments. Customers are contacted multiple times about payments even though they’re not yet overdue. Allegedly, some borrowers say they've been harassed and threatened with lawsuits if they don't pay back loans quickly.

CashCow reviews

CashCow has generally unsatisfactory reviews on Google Play Store and Facebook. Most of the reviews are about the exorbitant interest rates. Many borrowers were surprised that they only got about 60% of the original loan amount they applied for. Aside from not getting the full amount, they have to pay off the loan in just 7 days, which is too short a time to get funds. As a result, they end up paying late, which has corresponding penalties in the form of late payment fees and higher interest. In worst cases, some borrowers end up not being able to pay.

Customers had to deal with rude loan officers who were overly aggressive in their loan collection methods. There were some reviews that said that the loan collectors were harassing and intimidating borrowers. Some have even gone as far as to make threats of legal action and shaming on social media. With that said, CashCow’s customer service leaves a lot to be desired.

Have you used CashCow loan app? Share your experience here.