What is CashGo?

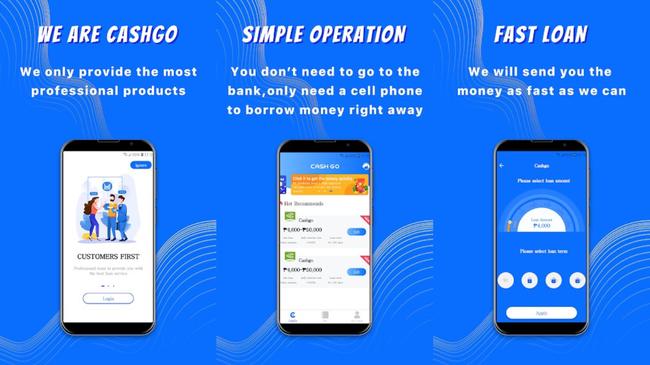

CashGo Philippines is an online lending app that provides easy and fast access to cash loans for its users. Through the Cashgo loan app, Filipinos can borrow quick cash for unexpected expenses and emergencies.

The CashGo lending app makes it easy to borrow money because there is no collateral required and credit checks are not necessary. This makes the process much simpler and faster, as there is no need to wait for the bank to approve the loan. Additionally, since there is no physical paperwork involved, the entire process can be completed from start to finish using the app.

This can be a great option for people who need money quickly but do not want to go through the hassle of getting a loan from traditional sources. It’s also helpful for people who are in need of financial assistance but are not qualified for loans from banks.

How does CashGo loan work?

CashGo loans work by providing borrowers with a short-term loan that must be repaid within a specific time frame. The loans can be used to cover sudden expenses or tide you over between paychecks.

You just need to download the Cashgo app from the Google Play Store or Apple App Store. Register using your mobile phone. After the verification, you must complete the online loan application form. This only takes less than 10 minutes.

After you submit your application, CashGo will review it, and if everything checks out, you’ll get approval in just a few minutes. The money is then deposited to your bank account within 24 hours, depending on the CashGo bank partner you selected.

How can I apply for a loan with CashGo?

The application process is simple and easy to follow. In order to apply for a loan, you must provide your name, address, mobile phone number, and ID. You will also need to provide information about your work or proof of income.

CashGo evaluates all applications individually and makes a determination based on the information you provided them. The loan amount and the loan term will be finalized. If you agree to the terms, CashGo will release the funds to your bank or e-wallet.

Requirements

-

You must be at least 18 years old.

-

You must have a valid mobile phone number.

-

You must have a valid government-issued ID.

-

Philsys

-

UMID

-

SSS / GSIS

-

Passport

-

Driver’s License

-

Postal ID

-

Voter’s ID

How much does CashGo loan?

You can borrow P5,000 up to a maximum of P20,000. The loan amount will be determined by CashGo based on the information you have provided. It’s common for first-time borrowers to get a lower loan amount. However, if they pay on time and maintain good credit standing, they can be given a higher loan amount.

CashGo loans are typically due within 7 days of approval, which is contrary to the advertised 91 to 365 days.

Based on CashGo’s SEC listing, the interest rate is 5.0% per month. However, according to CashGo’s published information, the maximum annual percentage rate is 18.25% or 0.05% per day. CashGo also charges a service fee on top of the interest rate.

How do I pay my CashGo loan?

When you take out a CashGo loan, you will be required to make monthly repayments until the loan is repaid in full. The repayment amount will be based on the amount you borrowed, the interest rate, and the length of your loan. This allows you to budget for the repayments in a predictable way.

You can make repayments through any of CashGo’s authorized partner payment channels:

-

7-11 stores with payment kiosks

-

M. Lhuillier branches

-

Online bank transfer

-

GCash

-

Coins.ph

-

CLiQQ

If you want to avoid late payment fees and interest, you should make sure to pay your CashGo loan on time. Late payments can add up quickly, so it's important to stay on top of your payments. By making on-time payments, you'll be able to keep your finances in order and avoid any extra costs.

Is CashGo legit?

Yes. The CashGo app is operated by Catchcash Lending Investors Corp, which is listed with the Securities and Exchange Commission. It has a certificate of authority to operate as a lending company. This means it is compliant with Philippine laws. It has been in operation since October 17, 2019.

CashGo app

The CashGo loan app works on Android and iOS devices and can be downloaded from the Google Play Store or App Store.

You may find links to the CashGo loan app APK on some websites. Keep in mind that the CashGo loan app APK app is not recommended for download because it may contain malware or other harmful programs that can steal your personal information and use it for fraudulent activities. The app may also be unstable and cause your device to crash. Additionally, the CashGo APK app may not work properly with your device or operating system.

CashGo customer service

CashGo customer service provides support for customers on loan applications and payment issues. The customer service team is available to help with any questions or concerns that you may have. There’s no official CashGo website, but the customer service team can be reached by phone or email.

CashGo Customer Care Number:

- +63 9054674768

Email address:

CashGo complaints

CashGo users have voiced complaints about the high interest rates and service fees the company charges. In particular, users complain about the high annual percentage rate (APR) on outstanding balances. Additionally, CashGo charges service and transaction fees, which have not been explicitly disclosed.

Another common complaint is the loan term of only 7 days, which is contrary to the 91 days that CashGo initially advertised.

But what’s particularly alarming is that some CashGo users have complained about some agents who use social shaming and harassment tactics in an attempt to get borrowers to pay their debts. There have been allegations that they have been harassed or threatened with legal action, or even having their personal information shared on social media if they are unable to make payments. This type of behavior is not only unethical, but it can also be damaging to the borrower's reputation.

CashGo reviews

The CashGo app has an average rating of 3.4 stars on the Google Play Store and 4.7 stars on the App Store. The positive CashGo reviews are mostly about the app’s user-friendly interface, which makes the loan application process quick easy. Users also praise the quick loan approval time after the application has been submitted

CashGo’s negative reviews stem from complaints about high interest rates and bad customer service. Customers often have difficulty getting in touch with a representative, and when they finally do, they are often unhelpful or aggressive. CashGo has some good aspects and some bad ones, which leads to mixed reviews. This should help you decide whether or not to use the CashGo app to apply for loans.

Have you used CashGo loans? Share your experience here.