What is Fast Cash?

Fast Cash is an online loan app operated by Fcash Global Lending Inc. It gives Filipinos easy access to short-term loans with flexible terms. All the processes for quick cash loans are done on the mobile app, so the processing and approvals are fast. It’s a convenient way to have emergency funds for medical expenses, car repairs, home renovations, or unexpected expenses.

Borrowers are given a viable option that is much more convenient than having to go to a physical bank location to apply and submit documents. Fast Cash is an unsecured loan, which means there’s no collateral required. It’s designed for people who are not qualified for bank loans, have low credit scores, have no credit history, or have no assets to offer as collateral.

Fast Cash also offers competitive interest rates and terms, making it a good option for those looking for financing.

Fast Cash loan, how does it work?

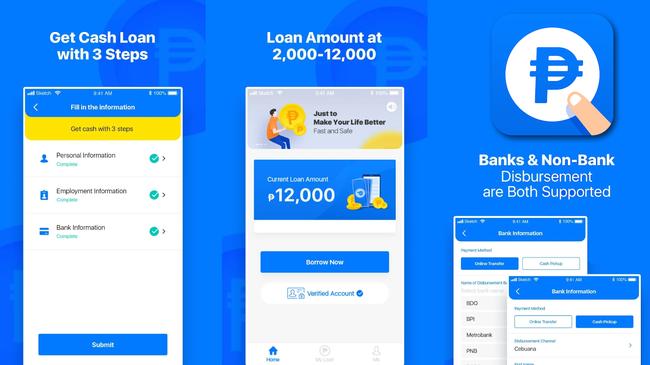

Fast Cash loan is simple, fast, and convenient. You can borrow money for any purpose you like. Everything happens in the Fast Cash mobile app. You must first download the app from the Google Play Store. It’s currently not available for the iPhone.

Once you have registered and verified your identity, you can apply for a cash loan using the app. Fill out the application form and provide the necessary documentary requirements. Once submitted, Fast Cash will process it. Upon approval of the loan amount, you will receive the money in your bank account within minutes. If you opt to receive the money through Padala Centers, you will be able to get the details on how to collect the money.

Interest rate

Fast Cash’s interest rate is 1% per day within the due date. There’s a 20% surcharge for new borrowers and 15% surcharge for repeat borrowers. With the additional charges, you’ll not get the entire loan amount you applied for. The loan term is listed as 91 to 120 days, but Fast Cash usually approves 7 and 14 days for starters.

How much does Fast Cash loans?

The maximum amount that you can borrow from Fast Cash is PHP20,000. Fast Cash will start you off with a lower loan amount, but as you build your credit history by paying on time, you’ll be given a higher amount on your subsequent loans.

Is Fast Cash SEC Registered? Is legit?

Yes. Fast Cash loan Philippines’ parent company, Fcash Global Lending Inc., is registered with the Securities and Exchange Commission (SEC) on March 22, 2018. It’s a legit company that has a certificate of authority to operate as a lender.

The SEC monitors the activities and financial health of online loan app operators to protect borrowers and ensure that the interest on loans is not unlawfully high.

Fast Cash loan benefits

There are many benefits of using the Fast Cash online loan app. Perhaps the most obvious benefit is that you can easily access these apps from anywhere with an internet connection. This means you can apply for a loan no matter where you are. What’s more, the Fast Cash app has a user-friendly interface that makes the loan application process easy and quick.

Another benefit of using online Fast Cash loans is that you can typically get a decision on your loan application very quickly. In some cases, you may even be able to get your money within minutes of applying. This is much faster than traditional methods of obtaining a loan, such as going through a bank or a loan company.

When you need some extra cash in a hurry, Fast Cash can be a great way to get your hands on some money quickly. This can greatly help if you need money for an emergency expense or if you're short on cash before your next payday.

Fast Cash loan online application process

The loan application process is done through the mobile app. It has minimal documentary requirements, so you don’t need to worry about doing paperwork and legwork.

Here are the steps for applying for a loan:

-

Download the app.

-

Register to create an account.

-

Click the “Borrow Now” button.

-

Indicate the loan amount you wish to borrow.

-

Click the “Submit” button.

-

Indicate preferred disbursement method.

-

Proceed to face verification.

-

Submit your application.

-

Your application will be reviewed by Fast Cash. Once approved, the funds will be disbursed within 24 hours, except when it falls on a holiday or a weekend.

Requirements

-

You need to provide personal information, employment information, bank account, and contact details.

-

You must have a valid ID.

-

You must have a working mobile phone number.

How do I get a referral code?

Many online loan apps have referral programs. It lets you earn money by referring friends and family members to the platform. All you need to do is enter your referral code when they sign up and you'll get a commission on every approved loan.

Fast Cash does not offer referrals at this time. If there are referral programs and special offers, you will be notified via text or email.

How to pay the Fast Cash loan?

You can repay your loan through authorized online banks and authorized payment centers like Cebuana Lhuillier branches. Your monthly dues are indicated in the app and you will receive notifications days prior to the due date.

What happens if you can't pay?

When you borrow money from Fast Cash, the lender will give you a specific amount of time to pay it back. The loan term is the length of time that the lender has given you to pay back the loan, including interest and fees.

If you do not repay the loan in this time frame, Fast Cash will charge a 2.5% daily penalty fee (after the due date) and a 5% late payment fee. These fees can add up and it will make it even more difficult for you to pay off your loan.

In the worst case scenario, Fast Cash may take legal action against you. So, it is important to read the terms of your loan agreement carefully so that you understand your obligations.

Fast Cash app

At this time, the Fast Cash loan app is only available for download at the Google Play Store, so it can only be used using an Android phone.

The app is easy to use because of its uncluttered interface. It's intuitive and it guides the user on what to do next to complete the loan application. The layout is simple and straightforward, making it easy for anyone to navigate. Plus, the app has a built-in help section that provides clear instructions on how to use it.

Fast Cash APK

When you download the Fast Cash app from the Google Play Store, you can be sure that it is safe. If you find Fast Cash APK, don’t download it. This file format is not as secure as the ones in the official store.

An APK file can be easily decompiled, which means that someone could extract the source code from the file and view it. This could potentially allow them to steal your data or infect your device with malware.

Fast Cash, phone and customer service

For questions, issues, or complaints, you can contact the Fast Cash customer service via e-mail at cs@fcash.ph . Alternatively, Fast Cash can be reached via mobile phone at 0933 8295658.

Fast Cash complaints and harassment

Using Fast Cash is not without its problems. Complainants allege that they are being harassed and threatened with legal action if they do not repay the loans. In some cases, agents subject borrowers’ references and contacts to threats and harassment. Borrowers are also being threatened with being exposed on social media. If you experience harassment from online lending apps, contact and file a complaint with the SEC.

Fast Cash, review

The Fast Cash loan review rating is 3.6 stars in the Google Play Store. Reviews are generally positive when it comes to the use of the app as well as the quick loan processing. However, borrowers are not happy with the customer service, citing unprofessional and rude agents.

Have you used the Fast Cash Loan app? Share your experience here.