What is Gcash?

Gcash is a digital payment platform that allows users to send and receive money. It also offers a peer-to-peer lending feature where people can lend money to other users who need it. It also It provides cash loans, credits, and allows the users to buy and sell digital goods like games, apps, music, and movies.

Home Gcash loan, how does it work?

GCash offers its users different loan options, including fixed and variable rate mortgages, personal loans, and installment plans for other purchases. In GCash loan, you have an option to borrow up to PHP 25,000. This loan has a flexible term depending on your preference that includes interest rates and processing fee.

How much is Gcash personal loan?

As aforementioned, GCash allows borrowers to loan money up to PHP25,000. But if you have just begun borrowing from them, the maximum loan amount you can have is only up to PHP 10,000. You can increase your GCash loan amount by using the app itself for paying bills, shopping online, and increasing your GCredit limit.

Interest rates

The GCash personal loan has interest rates that varies from 2.6% to 4%. It also has a processing fee of 3%.

Is Gcash legit? Is SEC registered?

Yes. GCash is legit and a secured online payment application that is functioning under Securities and Exchange Commission (SEC) policy with registration number of CS201617622 and C.A. No. 1897.

Is a quick loan? How long does it take to claim the loan money?

Once your application is approved, Gcash will send you your borrowed money within 24 hours.

Gcash benefits

Gcash Philippines offers a wide range of benefits for their users. Some of these benefits are: Online payments, Cash withdrawals, sending money to friends and family, and Credit card rewards.

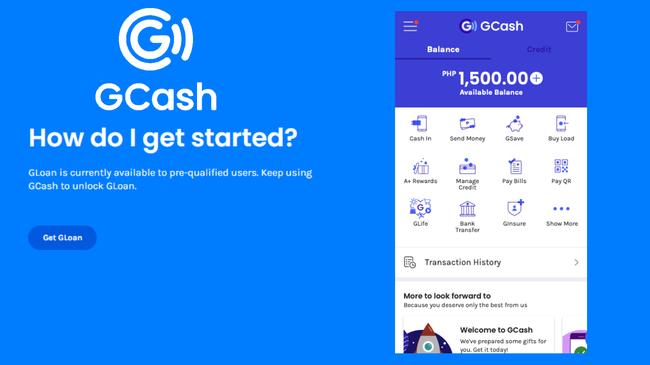

How to apply for a loan via Gcash?

Current customers of Gcash will receive a text message if they are eligible to apply for a Gcash loan. Moreover, applying for it is pretty easy. The following are the preceding steps to apply for a Gcash loan.

-

Log in to your Gcash account and tap GLoan under the Financial Services of the dashboard.

-

Tap Get started and input your loan amount, duration of the repayment, and purpose of the loan.

-

Review the loan terms, your personal information, and the loan agreements including the Data Privacy.

-

A one-time code will be sent on the phone number you provided, enter it and then submit.

-

A reference number will be sent to you and the money you borrowed will be sent on your Gcash wallet within 24 hours.

Requirements:

-

Your GCash profile needs to be fully verified via the GCash app using any of the following IDs:

- Driver’s License

- Passport

- Postal ID

- Professional Regulations Commission (PRC) ID

- Social Security System (SSS) ID

- Unified Multipurpose ID (UMID)

- Voter’s ID

- Home Development Mutual Fund (HDMF)/ Pag-Ibig ID

- PhilHealth ID

- You must be a Filipino National.

- You must be 21 to 65 years old.

- Your Email must be verified.

You should have a qualified GScore* and a good credit history.

Loan calculator

A Gcash loan calculator is available on their website, as well as when you are about to apply for a Gcash loan.

Online application

Application for a Gcash loan can be fully done online. As of now, there are no manual applications.

How to pay Gcash loan installments? Where can I pay?

You can repay your dues using the Gcash app itself. Just go to the Loan management on the dashboard and enter your credentials as necessary. Auto-deduct for GLoan dues is also available in Gcash wallet.

7-11 fees

If you wish to pay your GLoan dues via 7-11, you can cash in to any 7-11 store using CliQQ App or CliQQ Kiosk.

Balance payment

There is no minimum balance to keep your Gcash account active. However, if you are not making any transaction within 6 months and your balance remain zero, your account will be automatically closed without further notice from the app.

What happens if I can’t pay?

On any case of late payment, a PHP 100 fixed fee and 0.15% of your total outstanding principal balance on Gcash will be deducted on your account daily.

About Gcash 8K limit

Cash in is free in all over-the counter outlets nationwide. But once you reached the monthly threshold of PHP 8,000, there will be a service fee of 2% for every time you cash in.

Gcash loan app

Logging in on Gcash is pretty easy. Once you have your account and credentials, it is a requirement to set up a 4-digit pin code. This pin code will serve as your password every time you are about to login on the app. You can change this anytime.

Gcash login steps

If you are a new user:

-

Launch the Gcash app.

-

A pop-up screen will appear, tap Yes.

-

Enter the number you registered and the 4-digit pin code you set up upon registering.

Gcash customer service

If you wish to raise a concern, you can reach out to Gcash through any of the following contact information.

Free hotline

- Customer Care hotline (2882)

Globe number

- Unfortunately, a Globe Number is not available to contact Gcash. But you may submit a ticket in their GCash Help Center.

Email address

- If you prefer emails, you may email support@gcash.com for any concerns.

Address

- A physical branch address for Gcash is not available at the moment.

Gcash reviews

A lot of people are using e-wallets nowadays, and it is undeniable that Gcash is the most preferable e-wallets of many. People are saying that it is easy to use and has a 4-star rating on Google Play Store.

Have you used the Gcash loan app? Share your experience here.