What is GCredit?

GCredit is a revolving credit line available in the GCash app. With GCredit, you can borrow money without the need to go through a credit check. This makes GCredit a very flexible option for people who need money quickly but don't want to go through the hassle of applying for a traditional loan. CIMB Bank handles GCredit loans on the GCash mobile app.

GCredit, how does it work?

GCredit functions like a credit card that you can use to purchase items from QR partner merchants that accept GCash. You can also use it to pay bills from participating billers.

To unlock the GCredit feature, you must first meet the required GScore. Gscore is GCash’s credit scoring system that determines eligibility as well as the credit limit. Once you pay off your availments, your credit limit is replenished, and you can use it again.

How much is the GCredit loan?

Depending on your Gscore, you can avail a GCredit loan of PHP10,000 to PHP30,000. As you keep using your GCredit, your credit limit will increase. This is because GCredit monitors your spending and repayment habits and awards you with a higher credit limit based on your responsible use. So, continue using your GCredit card responsibly and watch your credit limit grow.

Interest rate

GCredit’s interest rate is 5%. This interest is pro-rated, which means it is spread over the number of days you availed of the credit facility.

Is GCash legit?

Yes. GCash is operated by the fintech company Mynt, which operates under Globe Telecom, the second largest telco in the Philippines. Mynt is listed with the Securities and Exchange Commission under Globe Fintech Innovations Inc.

How long does it take for the money to arrive?

GCredit works like cash that you can use to purchase items from participating shops or pay bills. You don’t have to wait for the money to arrive because it’s as good as cash. You just need to use the GCash app to use the GCredit feature.

GCredit benefits

-

GCredit is the new, convenient way to pay for the things you need. You can use it at any of the participating shops. Currently, there are more than 60,000 merchants that accept GCredit.

-

Enjoy interest rates as low as 3%.

-

Get access to exclusive perks like discounts and cashbacks.

How to apply for GCredit loan?

GCredit is built into the GCash app. So, you must first download the app from the Google Play Store or Apple App Store and then create a GCash account. To enjoy all the amazing features of GCash and GCredit, your account must be fully verified. You only need to submit a valid government-issued ID and take a selfie. Fill out the form with required personal information, including nature of work and source of funds.

Requirements

To be eligible for GCredit, you must meet the following requirements:

-

Must be 21-65 years old

-

Must be a Filipino citizen

-

Must have a fully verified GCash account

-

Must maintain a good Gscore

-

Must have good financial record and no history of fraudulent activities

How to activate GCredit?

GCredit will activate when you reach a certain Gscore.

GCredit score

Gscore is your overall trust score that you build from using GCash to pay for transactions. The more you use your GCash, the higher your Gscore will be. It’s also the basis for your credit limit. A good Gscore will unlock the GCredit feature of the GCash app.

How many Gscore to unlock GCredit?

There’s no definitive scoring guide released by GCash, but a Gscore of more than 600 points will activate GCredit with a credit limit of PHP10,000. Getting the maximum Gscore of 750 will unlock the maximum credit limit of PHP30,000.

How to increase GCredit?

To increase your GCredit, you must keep using your GCash for the following transactions:

-

When you cash in

-

When you pay for items using QR code

-

When you pay bills using GCash

-

When you save money via GSave

-

When you Invest via GInvest

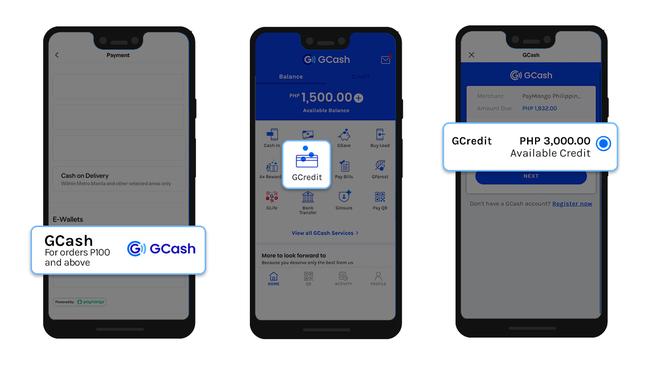

How to use GCredit in GCash?

How to turn GCredit to cash?

At this time, there’s no feature that enables transfer of funds from GCredit to GCash wallet. However, you can use GCredit just like a credit card. It gives you purchasing power akin to having cash.

How to use GCredit to bank transfer?

There’s also no option to deposit money from GCredit to your bank account.

Where can I use GCredit?

How to use GCredit in Shopee?

-

Add an item in your Shopee cart.

-

Go to Checkout and select payment option.

-

Click on Payment Center/e-wallet.

-

Select GCash. This will redirect you to GCash screen.

-

Select GCredit when prompted to choose the source of funds.

How to use GCredit in Lazada?

At this time, Lazada does not accept GCredit as payment for items. However, you can still use your GCash wallet. Just make sure it has enough funds.

How to use GCredit in Foodpanda?

Foodpanda only accepts GCash. There’s no GCredit in the list of Foodpanda payment options.

How to pay GCredit loan?

There are a few things you need to do in order to pay off your GCredit loan:

- The billing period follows a 30-day cycle.

- Your due date is based on the date your GCredit was unlocked.

- It’s always 15 days after the billing date.

On your Gredit dashboard, you’ll see the due date, total amount due, remaining credit limit, total credit limit. Make sure you have the money in your GCash wallet to cover the amount that needs to be paid. Once you have the funds, click the “Pay for GCredit” button. You can enter the amount that you can afford or select the total amount due. You also have the option to pay only the minimum amount due.

Can you pay installment in GCredit?

No. There’s no installment option for GCredit. However, you can pay the minimum amount due if you don’t have enough funds to pay for the total amount. Just keep in mind that added interest will be charged.

Alternatively, you can use the GGives feature when you purchase from merchants instead of using GCredit. GGives lets you pay for items in easy installments.

What happens if I can’t pay?

If you don’t pay your GCredit dues on time, you will incur penalties and additional charges.

GCredit penalty

Here are some of the consequences you have to face if you don’t pay on time:

-

Your GCredit will be suspended. You will not be able to use the credit facility.

-

You will be charged penalty charges of PHP200 to PHP1500 depending on the number of days late. This will be reflected on your due date.

-

You will have to pay additional interest charges.

-

You will receive payment reminders from in-app prompts, email, and text.

-

You credit score will take a hit and it will be hard for you to get loan approvals from banks and lending agencies in the futures. This is because your Gscore is shared with lending companies as mandated by the Bangko Sentral ng Pilipinas.

GCredit, customer service

-

Hotline: 2882 for Globe Subscribes

-

Contact number: (632) 7730-2882.

-

Email address: support@GCash.com

-

Address: The Globe Tower, 32nd Street corner 7th Avenue, Bonifacio Global City, Taguig

GCredit, reviews

GCredit has generally positive reviews, largely due to the ease of use and how it is widely accepted by thousands of merchants nationwide. It’s a convenient option for people who don’t want to carry around a lot of cash or for those who simply need funds in between paydays. A lot of users like that it works just like cash or credit card without the annual fees.

On the downside, there’s been clamor for more robust safety features for the GCash app as it appears to be used by some shady people for fraud and scam. But despite this, GCash and GCredit are widely used and trusted by Filipinos for their cash-less transactions.

Have you used Gcredit? Share your experience here.