What is Kusog Pera Lending?

Lending has been an important part of Philippine history. People lending money has been a common practice in the country for a long time. This can be seen with the help of rulers and other people of authority, and it can be seen today with the financial institutions that loan money to entrepreneurs.

Kusog Pera Lending is a lending app from the Philippines. It is an app that offers a small loan to help people who can't get a loan elsewhere. The app is used by consumers, companies, and individuals. All the loans are made through direct bank transfers. The aim of the app is to offer micro-loans to those who usually don't have access to loans, such as the poor and the middle-class.

The app, which is available on the Google Play store, is designed to help Filipinos gain access to loans without having to find a bank. The app is designed to make it easy for people who need loans to get them and to make the process quick and easy.

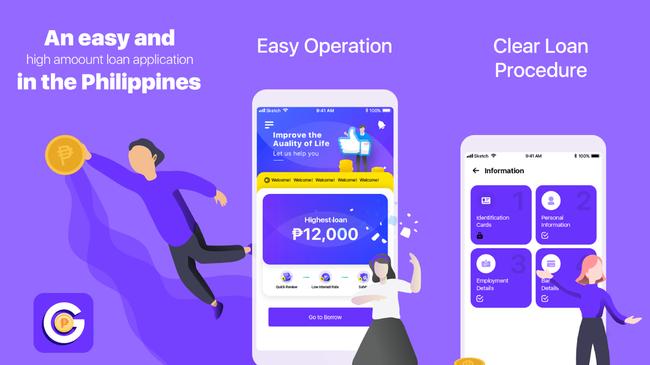

Good Cash loan, how does it work?

Good Cash Loan is a small loan service that allows an individual to borrow up to PHP 5,000.00 to PHP 20,000.00, depending on your monthly income. It is the simplest way to borrow money online. Good Cash loan is a type of online loan service that is easy to use, fast, and convenient. No paperwork is required, and you can earn a higher loan amount by paying your loan back on time.

Good Cash Loan is a service that allows Filipinos to borrow from the comfort of their homes. It is a quick, easy, and affordable way to borrow money. To get a loan, you can fill out the application on our website and wait for the loan provider to email, call, or text you with the next steps.

Interest rate

The interest rates available with Good Cash Loan is 18% per year, which is roughly 0.5% a day. This percentage is considered an average knowing that Filipinos doesn’t have to worry about having a high credit score to borrow money from Good Cash.

Is Good Cash legit?

According to the website, Good Cash is a product of Good Financial Ltd. and is licensed under #0911/2022. Good Cash is a no-risk loan that you can use to solve your emergency or urgent financial needs or even your day-to-day expenses.

However, there’s no evidence that this loan app is legit since it is not listed to the Financing and Lending Companies Registered with the SEC or Securities and Exchange Commission.

How much is the Good Cash loan?

Good Cash is a loan platform that allows Filipinos to borrow PHP 5,000 to PHP 20,000 within 24 hours. What started as a personal loan platform has now expanded to a micro-loan platform. The company is based in the Philippines, but we believe that they also have an international presence based on their website. This means that they are able to give loans to people around the world.

Is Good Cash loan app SEC registered?

There is no Good Financial Ltd. or Good Cash Lending app registered with the SEC, but Kusog Pera Lending listed as Kusog Pera, SnaPera are registered – which we believe is the parent company of Good Cash.

Good Cash loan app benefits

Good Cash is a personal loan app designed to provide a solution for Filipinos and who need cash in a short period of time. With a few clicks of the app, you can borrow a portion of your monthly salary. The loan can be used for anything from emergency funds to starting a business. Furthermore, people in the Philippines are able to borrow up to PHP 20,000 in a quick amount of time.

It's very easy to get a loan right now with a Good Cash loan app. The loan application process is a breeze and the loan application process is done on the app.

Good Cash loan, how to apply?

If you are looking to receive a loan, you should download the app and complete the application. Once you download the app, you can start the application process. With the application, you will need to provide some personal information, such as your name, address, ID number and mobile phone number. You will also have to provide your salary and employment history. When you are done with the application, you can choose to receive a loan that ranges from PHP 5,000 to PHP 20,000.

In case your application process has been approved, a customer service representative will get in touch with you. Finally, agree with the terms and conditions and get the money.

Requirements

According to their website, the following are the requirements by Good Cash.

-

Philippine address

-

Name, contact number, email

-

Government-issued IDs

-

Proof of income and proof of address

Good Cash loan app

Good Cash loan app is available on their website to download as well as in Google Play Store.

App download

If you want to download the app, you can go to https://goodcash.co/ , or simply download it to your Android phone.

Good Cash APK

Good Cash APK is accessible and available on this link .

Good Cash, customer service

In case you have any concerns or thoughts about your loan, Good Cash Customer service is available to be contacted through the following contact information.

Hotline

International Hotline + 852 9847 4943

Good Cash, complaints

Good Cash loan Philippines is a personal loan company that specializes in providing financial and business loans to people in the Philippines. Good Cash loan offers customers with a range of flexible terms. Some complaints are based on the user’s reviews and it’s about the app or the hidden fees associated with the loan.

Good Cash, reviews

Good Cash have a variety of loan products, including flexible terms, fixed terms, and interest rates. They provide a solution for borrowers with a wide range of credit scores. The loan has been reviewed by nearly one thousand individuals, and it’s most between 3 to 4 stars.

Have you used the Good Cash loan? Share your experience here.