What is Home Credit Philippines?

Since 2013, Home Credit has been known to provide different financial products that will help Filipino people with their everyday purchases of various items. Home Credit Philippines aims to promote financial inclusions for everyone by offering loans, store financing purchases, and Buy Now, Pay Later. This company will let the borrower buy appliances, mobile devices, and even cash on hand.

Home Credit Cash Loan, how does it work?

Obtaining cash loan lets you buy an item or service that is part of your long-term plan for financial freedom. It can even pay your bills or any emergency expenses. Luckily, Home Credit offers cash loans and the application is very easy. You can just download their Home Credit app and just within 10 minutes of your time, the borrowed cash will be on your hands.

You can pay back the amount you borrowed through monthly installments. Home Credit has a loan calculator available on their website. The Home Credit loan calculator lets you compute the money you have to pay back every month depending on the number of months you prefer.

How much are Home Credit loans?

The minimum amount you can borrow is 2,500 pesos. While the maximum account depends on the company itself. Once they’ve reviewed your application and see that you have a high, good credit score, they may offer you an increased credit limit.

Home Credit also allows businesses to borrow capital money for up to 150,000 pesos. Moreover, you can avail the Borrower Protection Plan Insurance during your loan application.

Interest rate

The interest rates of Home Credit loans can vary starting from 2% per month. While the repayment period can be 6 to 48 months for new customers.

Is Home Credit legit? Is it SEC-Registered?

Yes, Home Credit is legit. There are lots of people who use their financing services to cover different expenses. The company is also in compliance with Securities and Exchange Commission SEC Reg. Number: CS201301354 Certificate of Authority Number 1071.

How long does it take to claim the loan money?

Once you are done submitting your application and fulfilling all the necessary Home Credit requirements through the Home Credit app, just wait for their approval (usually within 1-2 minutes). Assuming that your application was approved, you can click “sign the contract” and they will send the OTP on the phone number you provided. Finally, you will receive an SMS or text that says the money you borrowed is ready for claiming.

Home Credit Philippines benefits

Aside from Cash loans, Home Credit also offers Consumer loans, bills payments, HCProtect for devices, Covid-19 medical support, and even credit cards. Indeed, the financing services of Home Credit will let you reap the benefits and pay it back in the future.

How to apply for a Home Credit cash loan?

You can apply for a Home Credit cash loan through their online application in Home Credit App. Follow the preceding steps to know how you can apply for one:

- Login to the My Home Credit App and click “Apply Now” in the loan cash banner.

- Choose the amount you want to borrow and the number of monthly installments you prefer. Once done, review the loan summary and click “Continue”.

Tip: This is where you should use the loan calculator available on the Home Credit App.

- Complete all the necessary details and provide 2 valid IDs. Make sure that you are providing the right information so your requirements will be eligible.

Tip: Submit primary IDs that reflect your current IDs. The following are examples of primary ID. PASSPORT, SSS, GSIS, TIN, UMID, Driver’s License (Professional, Non-professional, Student and Conductor’s License), Voter’s ID, PRC, New version and brown Postal ID (brown postal ID is only valid until May 2019), and Philsys ID.

- After submitting all the requirements IDs, wait for the approval of your application. The time for approval is short and usually takes 1-2 minutes. Once done, click “sign the contract” and wait for the OTP through SMS using the number you provided.

-

Congratulations! You can now use the money you borrowed to purchase products or services.

Requirements

- Filipino citizen.

- Have from 18 to 68 years old.

- Proof of income.

- 2 valid IDs.

- Email address.

- Phone number.

- Downpayment.

Home Credit Payment Process

You can pay back through online banking, e-Wallets, over-the-counter, or even at 7/11 stores. If you want to avoid penalties and charges, make sure to pay back on time.

Balance payment

You can view the due date, installment amount, total remaining balance, and remaining installment on the My Payments website portal or the My Home Credit mobile app.

What happens if I can’t pay?

A Collection Charge will be imposed on each of the installment amounts you failed to pay after 5 days. In addition, a Relevant Penalty will be imposed if you failed to pay after 30, 60, or 90 days after the actual due date.

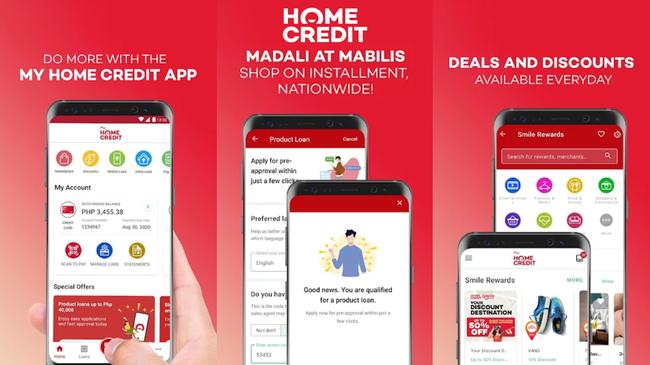

Home Credit App

If you want to view your loan details, apply for one, pay online, or update payment channels, log in to My Home Credit App:

-

Download the My Home Credit App.

-

Log in using your loan account number (email address for new customers) and your date of birth.

The same information is needed to log in through their My Portal website. Click this link https://homecredit.ph/account-management/ for more.

Home Credit Customer Service

If you wish to raise a concern about your loan or reach Home Credit regarding their financial products, you may contact them through the following information:

Phone Numbers

- (02) 8424 6611 (PLDT)

- (02) 7753 5711 (Globe)

Email Address

You may call them between office hours: 8 AM to 9 PM daily.

Home Credit Reviews

Home Credit has a rating of 4.1 stars on JobStreet, 3.9 stars on Philippine Indeed, and 4.5 stars on Facebook. This financial service has been very helpful in solving monetary dilemmas of Filipinos – no wonder why a lot of people are using it and leaving positive feedback about their app.

Have you used the Home Credit cash loan? Share your experience here.