What is Lendpinoy?

Lendpinoy, a digital financial platform that provides microloans to Filipinos in need of quick cash to fund their needs, has been rebranded to TOMO. The name change is meant to reflect the company's mission to be a trusted friend that helps Filipinos financially.

Since its launch in 2018, Lendpinoy has been serving the unbanked and underserved Filipinos with quick and easy loans with minimal documentary requirements and no collateral.

Lendpinoy is owned and operated by AND Financing Corporation. With the rebranding to TOMO, the company hopes to reach more people, provide access to loans, and help manage their finances.

Lendpinoy loan, how does it work?

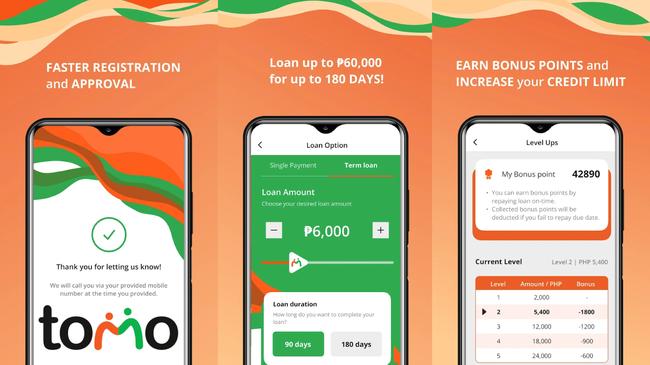

The loan application process is simple and straightforward: borrowers can apply for a loan through the TOMO mobile app and receive the money in their bank account within minutes. There are no hidden fees or charges. What you see is what you get.

The loan amount will be disbursed to any of the following options:

-

Borrower’s bank account

-

Borrower’s fully verified e-wallet

-

Partner remittance center Direct Agent 5 (DA5), an authorized direct agent of Western Union in the Philippines.

Interest rate

The interest rate for TOMO loan is 6% per month. It also has a flexible repayment period, allowing borrowers to repay their loan over a period of 3, 6, 9, and 12 months. This makes it easy for borrowers to manage their finances and repay their loan on time.

How much does Lendpinoy loans?

Lendpinoy offers a loan amount of PHP5,000 to PHP100,000. If you’re a first-time borrower, you may not be approved for the maximum amount right away. You’re likely to be given a lower amount. However, if you pay on time and establish a good credit history with Lendpinoy, then you’ll be eligible for higher amounts on your subsequent loan applications. You can also request for further assessment if you wish to have a higher loan amount.

Is Lendpinoy legit? Is SEC Registered?

Tomo by Lendpinoy is legit. It’s owned by AND Financing Corporation, which was registered with the Securities and Exchange Commission (SEC) on November 7, 2018. It has a Certificate of Authority to operate as a financing company. Registered companies are subject to strict regulations set by the SEC, so they are trustworthy.

Lendpinoy benefits

-

Getting a loan from Lendpinoy is fast and easy and you can receive the money in as little as 24 hours.

-

Lendpinoy's loans are unsecured and can be used for various purposes such as home improvements, medical emergencies, or business expansion.

-

Not only is it a convenient way to get a loan, but you'll also benefit from competitive interest rates. Loan terms are flexible and can be customized according to the borrower's needs.

-

When you repay your loan on time, you can earn bonus points or have your credit limit increased.

-

Another great thing about the Lendpinoy app is that it's completely free to use. There are no hidden fees or charges, so you can borrow with confidence knowing that you won't be paying any extra costs.

How to apply for the Lendpinoy loan?

Applying for a loan with Lendpinoy is simple and can be done in just a few steps. First, you will need to download the TOMO app from the Google Play Store or the App Store. Once you have installed the app, open it and create an account. Once you have registered and logged in, you will be able to see the different loan options available.

Choose the loan amount and repayment period that best suit your needs and submit your application. You will then need to upload some documents, such as your ID, proof of income, and proof of address. Once your application has been approved, you will receive the money in your account within minutes.

Requirements

-

Must be a Filipino citizen.

-

Must be 21 years old and above

-

Must be working in Metro Manila.

-

Must be living in the following areas: Metro Manila, Cavite, Laguna, Bulacan, and Rizal.

-

Must be employed for at least 6 months

-

Must have a monthly income of PHP15,000

-

Must have an SSS

-

Must provide a valid Government-issued ID (e.g., UMID, National ID, passport, driver’s license.

-

Must have a valid e-mail address and mobile phone.

How to pay the Lendpinoy loan?

You can pay your loan through any of the following authorized payment channels:

-

Maya Bank Transfer

-

7-Eleven branches using the CliQQ app or CliQQ machine

-

BDO Mobile App

-

DA5 Remittance Branches

-

GCash (via send to bank option)

Payments made through CliQQ are posted in real time, while other payment channels take 2 business days to be validated.

What happens if you can't pay?

Lendpinoy may charge you with late payment fees and additional interest. This can pile up if you keep missing payments, which will make it more difficult for you to pay off your loan. If you're struggling to repay your loan, you can get in touch with Lendpinoy through e-mail or phone.

Lendpinoy app

The Lendpinoy app is available for download on the Google Play Store and Apple App Store. The app is the perfect platform for those who need to borrow money quickly. The app has a clean, simple, and intuitive interface, making it easy for everyone to use.

Lendpinoy, customer service

-

Hotline: +63 961 660 0658

-

E-mail: contact@lendpinoy.ph

Lendpinoy, reviews

Lendpinoy review rating is 2.9 stars in the Google Play Store and 3.7 stars in the Apple App Store. The occasional technical glitches and app crashes contribute to the rating. However, some reviewers have expressed satisfaction on the quick loan processing and quick disbursement of funds.

Overall, Lendpinoy is a convenient and viable option for those in need of extra funds. The company's competitive interest rates and flexible repayment terms make it an attractive choice for borrowers looking for a hassle-free experience.

Have you used the Lendpinoy loan app? Share your experience here.