What is Union Bank?

Union Bank is one of the largest financial institutions in the Philippines. It offers a comprehensive range of financial products and services to individual consumers, small businesses, large corporations, and even some international clients from around the world.

Union Bank loan, how does it work?

Union.Bank offers quick loans, home loans, and auto loans. The bank is known for giving a generous amount of their loans with minimal interest rates. There will also be a processing fee but the documental requirements are lesser than any bank loans.

Quick loans

UnionBank quick loans are for people who wants to borrow money and have the latter on their bank account in just a matter of 1 minute after the application. This is perfect for college tuitions, medical emergency, or any life whereabouts.

Home loans

Union Bank offers home loans to all applicants, including first-time buyers, those who have existing mortgages with other financial institutions, as well as those who are self-employed. They have a simple online application for this as well as VIP customer service.

Auto loans

With UnionBank auto loans, you can purchase a brand new or second hand cars. Even brand new light trucks. The interest rates vary from 6% to 30% while the term loans can be 12 to 60 months.

How much does Union Bank loans?

Union Bank’s quick loan is the most common and preferred loans of their clients. The minimum amount you can borrow is PHP 1,000 while the maximum loan can be up to PHP 1,000,000.

Interest rates

The interest rates for UnionBank’s quick loan is not available on their website. But their home loans interest rates can fall between 8% to 11% and 13% for personal loans.

How long does it take to claim the loan money?

Union Bank Quick loans allows clients to claim the borrow money in just a minute. While for home and auto loans, the claiming terms are depending on the loaned amount.

Union Bank loan benefits

UnionBank offer customers a wide range of benefits on their loan services, such as:

- It offers one of the fastest application on the loan market.

- You can appl for a loan via the website.

- The approval of the loan is among the fastets as well in Phillipines.

- Although Union Bank loans are aimed for customers with a saving account in the bank, you can open one easily by using the UnionBank app.

As well, they can get help with personal loans, car loans, and home loans. To take advantage of these benefits, you can apply online or visit your nearest Union Bank branch in the Philippines.

How to apply for a loan in Union Bank Philippines?

Applying for a loan in Union Bank Philippines is very easy. They have a simple fill out form to complete and submit. The application process is very easy and straightforward, so you should not have any problem filling it out or submitting it. You can follow the next steps:

- Visit Union Bank website here: https://www.unionbankph.com/

- Click on "Loans".

- Choose the type of loan you're interested.

- Now you will have to follow the website's steps to fill the form and upload the requirements.

Also, they are known for their quick processing of applications, which usually takes less than 24 hours.

Requirements

If you wish to apply for a quick loan, you may access the link available on their website and make sure you have an Invite Code, Last 5 Digits of ATM payroll OR 12-digit payroll account number, Email Address, and a Mobile Number.

For home and auto loans, these are the usual Loan requirements a bank necessitates you to have:

-

(2) Government issued IDs with signature

-

Proof of billing address

-

If you are employed, you will need to submit the following:

-

COE -Certificate of employment with compensation

-

(3) months' pay slip

-

Latest Income Tax Return (ITR)* -ITR is not required for loan amounts below P3,000,000

-

If you are self-employed, you will need to submit the following:

-

Business Registration papers (DTI, SEC if applicable)

-

ITR with audited financial statements (2 years)

-

Trade references

Loan calculator

Union Bank loan calculator is available on their website. You may use it with or without an account if you wish to see the terms & conditions available on your preferred loan amount.

How to apply for a re-loan?

For quick loans, you have to wait for another invite code for re-loans. For home and auto loans, the same application steps apply.

How to check loan status?

You can check the status of your loan by online calling their Customer Service Support hotline.

Union Bank loan payment process

Repaying your loan is easy, you may do that through online banks, e-wallets, Mall Customer Service centers, or over-the-counter outlets.

7/11

If a 7/11 store is available near you, you can repay your UnionBank loan dues there as well. Just make sure to use any CliQQ kiosk and have your loan or reference number with you.

What happens if I can’t pay?

Union Bank has established the following late payment fees:

- 1-30 days – P200

- 1-2 months – P400

- 2-3 months – P600

- >3 months – P800

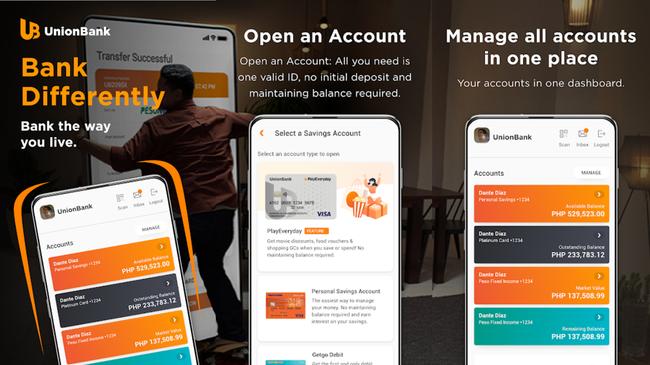

Union Bank app

The UnionBank app is an effort to provide all their customers with a convenient way to manage their accounts, transfer funds and make payments. The app also provides easy access to information about the bank’s products and services.

You can download the app from the next links:

- Union Bank App in Apple App Store.

- Union Bank App in Google Play Store.

Website

Their website has a clean and modern design with a focus on ease of use. And you may use it to find relevant information about the bank and its products.

How to login

Once you registered and created an account with Union Bank, you may directly go to their website, click “Login” on the upper right corner and then click “UnionBank Online”. Once done, enter your credentials such as User ID and password, then submit.

Union Bank contact number and customer service

If you wish to raise a concern, you may contact UnionBank on their respective contact information:

Hotline

- Metro Manila (+632) 8841-8600

- PLDT domestic toll free 1-800-1888-2277

- International toll-free (IAC) + 800-8277-2273

Email address

Union Bank loan reviews

The bank has received many positive reviews from its customers, and it is not surprising why - it offers competitive rates, quick service, and flexible repayment plans. The bank employees are welcoming and will discuss you all the beneficial things if you decide to go with their loans.

Have you used the Union Bank loan? Share your experience here.