What is Loanmoto?

Loanmoto is an online loan provider operated by U-Peso.PH Lending Corporation. It offers short-term, unsecured loans with flexible repayment terms. Through its mobile loan app, the process is fast, easy, and convenient. Loan approvals are just as quick, so you’re essentially availing of instant cash that you can use when you need it the most.

Loanmoto loan, how does it work?

To apply for a Loanmoto loan, you must first download the app from the Google Play Store. All the steps in the application process happen in the app. It only takes less than 10 minutes to apply.

How much is the Loanmoto loan?

For your first loan, you are limited to PHP2,000. However, if you pay on time and build your credit history with the company, the limit will be lifted and you’ll be given a higher loan amount of up to PHP10,000.

Interest rate

Loanmoto loans are charged an interest rate of 4% to 6% per month, depending on the amount and the loan term. The length of time you have to repay the loan is anywhere from 7 to 28 days.

Is Loanmoto legit? Is SEC Registered?

Yes. Loanmoto is a legit lending app run by U-Peso.PH Lending Corporation, which is registered with the Securities and Exchange Commission (SEC). Registering with the SEC ensures that the company is legitimate and abides by certain regulations. Since the company is subjected to regulatory oversight by the SEC, any unfair and unethical practices will not be tolerated.

How long does it take for the money to arrive?

Upon completion of the digital application form and the submission of documentary requirements, the Loanmoto app will process it immediately. Upon approval of the loan application, you can get your money via your preferred disbursement method within 24 hours. More often than not, cash is sent within a few hours.

Loanmoto loan benefits

-

Loanmoto’s quick loan approval means you get your money fast. This helps tremendously in times of emergencies and when unexpected expenses rear their ugly heads.

-

With minimal documentary requirements, the loan application process is quick and painless. You don’t need to do paperwork and legwork to apply for a loan.

-

The Loanmoto app’s user interface is highly intuitive and easy to use, which makes the application process smooth and seamless.

-

Frequent borrowers with good credit standing are invited to the exclusive Loanmoto VIP program, which requires downloading a separate Loanmoto apk app. VIP borrowers have higher loan limits and can enjoy exclusive benefits.

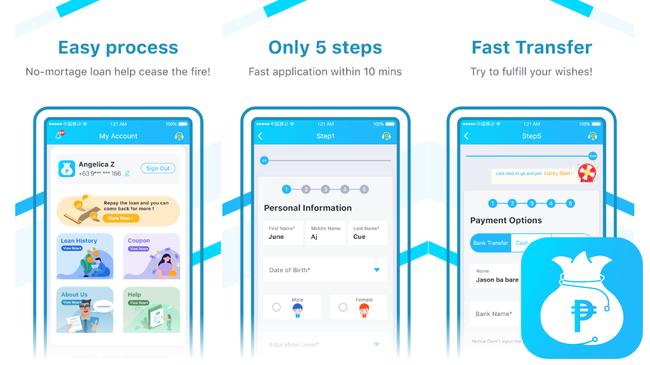

Loanmoto loan application process

You can apply for a Loanmoto loan and get your money quickly in just 5 simple steps:

-

Register using your mobile number.

-

Provide personal information as prompted (Name, Date of Birth, Gender, etc.)

-

Enter the desired loan amount.

-

Select your preferred payment option (Bank Transfer, Cash Pick-up, Others)

-

Submit the application and wait for approval.

Requirements

Loanmoto makes borrowing money a little bit easier with just minimal requirements:

-

Must be a Filipino citizen or a permanent resident

-

Must be 21 years old

-

Must have a valid government-issued

-

Proof of residence (e.g., utility bills)

-

Must have a valid contact number and e-mail

-

Bank account, debit card, or e-wallet where money will be transferred

Loan calculator

The Loanmoto mobile loan app has a built-in loan calculator, which can be a handy tool for anyone who is looking to take out a loan. The calculator can help you determine how much you can afford to borrow, and what the monthly payments will be. It can also help you compare different loan options to find the best one for your needs.

Just select the desired loan amount and loan terms and the loan calculator will work its magic and show how much you have to pay and the total amount of the loan including interest.

How to pay Loanmoto loan?

You need the loan reference number to pay your Loanmoto loan. You can find it on the loan app under the “Repayment” menu. You can also generate the barcode for 7-Eleven payments in the app.

You can pay your loan to any of the following authorized payment partners:

-

Skypay

-

Dragonpay

-

7-Eleven

-

GCash

-

RD Pawnshop

-

ECPay

What happens if I can’t pay?

If you can't pay your loan, there are a few things that could happen. The first is that you will be penalized with a late payment fee. This is typically a percentage of your outstanding balance, and it will be added to your account the next time you make a payment. Currently, the late fee is 3.5%. If you continue to miss payments, your account may be endorsed to a third-party credit collections agency. In some cases, your lender may also report your delinquency to CIC, which could negatively impact your credit score.

Loanmoto app

The app is available for Android devices only and it can be downloaded from the Google Play Store. Unfortunately, Loanmoto is not available for iOS phones.

-

Website: http://loanmoto.com

Loanmoto, customer service

Although Loanmoto’s contact number, but you can reach the company through the following channels:

-

Email address: LoanMoTo.ph@gmail.com

-

Address: 3 Aseana Ave, Tambo, Paranaque, Metro Manila

Loanmoto, reviews

The Loanmoto loan app gets high marks because it does what it’s supposed to do—initiate and process loan applications. It’s not a surprise that it gets an average rating of 4 stars in Google Play Store. However, this is overshadowed by some of the complaints brought up by some borrowers.

Loanmoto is not very transparent with the extremely high service fee it charges, which is deducted to the loan amount. So, you’ll end up with significantly less money than what you applied for.

Furthermore, Loanmoto has been criticized for its aggressive collection methods. Some customers have complained that they receive multiple payment reminders each day, and that Loanmoto's customer service is unresponsive.

Have you used the Loanmoto app? Share your experience here.