What is Madaloan?

Madaloan is an online lending platform that makes it easy for Filipinos to get access to cash loans. The app enables Filipinos to borrow money quickly and easily, with no need for collateral or guarantors.

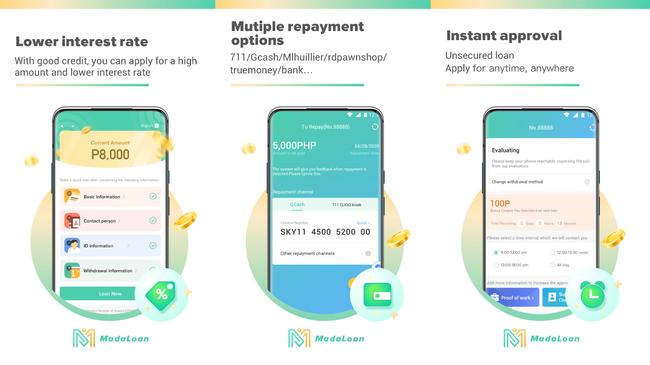

Madaloan’s mission is to create an inclusive financial system in the Philippines by providing quick and convenient access to credit for the unbanked and the underserved. With its simple application process, borrowers can receive funds instantly without having to deal with long waits or complicated paperwork. It also offers competitive interest rates and flexible repayment options, so users can manage their finances more efficiently.

Madaloan loan, how does it work?

Madaloan provides cash loans to borrowers who are in need of quick financial relief. It works by providing an easy application process and a fast response time to ensure that customers can get the money they need as soon as possible—and everything is done in the Madaloan mobile app.

The app uses mobile technology, algorithm, and big-data analysis to determine how much loan to offer to a borrower based on their profile and information provided. Once the loan application is approved, the money is then disbursed to the endorsed bank account or e-wallet.

Interest rate

The interest rate as published in the Madaloan website is 0.08% per day. However, in the Securities and Exchange Commission listing, the interest rate is 60% per for loan term of 7 to 30 days.

Is Madaloan loan app legit?

Yes. The Madaloan loan app is legit. It can be found on Google Play Store which currently serves as another indication of its trustworthiness. This is because each app undergoes automated testing for security and privacy compliance before being released into the wild. This means that you can trust the apps downloaded from Google Play Store as they have been verified by experts who ensure they meet certain standards of safety, security, and functionality.

How much is the Madaloan loan?

Madaloan offers borrowers loan amounts ranging from PHP3,000 to PHP20,000. However, the maximum loan amount is only given to repeat borrowers who have shown that they pay their loan on time and have built good credit standing

Is Madaloan loan app registered?

Yes. Madaloan app is owned and operated by IFun Lending Corp and Quark Financing Corp., which are companies that have been registered with the Philippine Securities and Exchange Commission (SEC) since September 21, 2021 and March 9, 2020, respectively. They have Certificates of Authority to operate financing and lending companies.

Madaloan loan app benefits

-

The loan app is a convenient and accessible way for many Filipinos to access fast loans. With quick approval, fast disbursement, and a range of payment options, the online lending app makes the loan application process stress-free and convenient.

-

Borrowers can expect an easy process when applying for loans. They are able to choose how much they would like to borrow and the repayment terms that best suit their individual needs. Once approved, users will have access to the funds within minutes, which means that they can quickly resolve any financial emergency or make upgrades in their lives with ease.

-

There’s minimal documentary requirement. As long as you are of legal age, have a stable income, a mobile phone, and a valid ID, you are qualified to apply for a quick cash loan.

Madaloan loan, how to apply?

The first step in getting a Madaloan is to download the app from the Google Play Store. After creating an account using your mobile phone, complete an online application form, which takes less than 5 minutes. Choose the loan amount and the loan payment term. Upload a valid photo ID and then submit the application. Wait for the approval.

Once your application is approved, you will receive the fund through the bank account or e-wallet you’ve endorsed. You can also collect the cash loan from authorized remittance centers.

Requirements

-

You must be a Filipino citizen.

-

You must be 18 years old.

-

You must have a stable job or a regular source of income.

-

You must have a valid photo ID:

-

Passport

-

Driver’s License

-

UMID

-

SSS

-

GSIS

Madaloan loan, how to pay?

If you’re ready to pay your loan, there are several options available. You can pay over the counter at banks, payment centers, or through online banking or mobile banking. All of these options provide secure payment solutions that ensures your loan payments are on time and accurate. Authorized payment centers are also available for those who need additional assistance when making their loan payments.

With all of these options available, it is easy to find a convenient way to pay off your Madaloan loan.

What happens if you can't pay?

In the event you are unable to pay your loan, you may be charged with late payment penalty fee, additional interests, and other associated fees. Debt collectors may also take aggressive steps if you are unable to make payments on time, which could include letters and phone calls demanding payment or threatening legal action.

It is a well-known fact that defaulting on your loan payments can have serious consequences. A poor credit score will make it more difficult for you to obtain future loans and financing, resulting in higher interest rates.

Madaloan loan app

Madaloan's loan app has an intuitive design and user-friendly interface. All functions and features are clearly labeled, allowing users to navigate through the app without confusion.

App download

The Madaloan app is available for download from the Google Play Store. It’s also available in the Apple App Store.

Madaloan loan app, customer service

Madaloan Contact Number and Hotline:

- +63 919 0798479

- +63 905 9064523

-

Madaloan Office Address: 1200 Sen. Gil J. Puyat Ave, Makati, Metro Manila

-

E-mail: cs@madaloan.com

Madaloan loan app, harassment and complaints

There have been complaints about the overly aggressive collection tactics of Madaloan debt collectors, with some borrowers claiming they have been harassed and treated disrespectfully. Reports of creditors calling borrowers’ contact lists are of particular concern. Borrowers are constantly bombarded with messages from creditors trying to collect on their loans even after business hours.

Other complaints are the exorbitantly high interest rates and fees that eat up the loan amount, leaving borrowers with less money than they anticipate. The short payment period of 7 days also makes it difficult for borrowers to pay the loan.

Madaloan loan app, reviews

The loan app has an average rating of 4.2 stars and 3.6 stars in Google Play Store and Apple App Store, respectively. Although these are generally positive, they are mostly indicative of the app’s performance. These are eclipsed by strong criticisms about company’s unacceptable collection methods.

Have you used the Madaloan loan app? Share your experience here.