What is MocaMoca?

MocaMoca is an online loan app that offers short-term loans with no credit check. Its goal is to help people in the Philippines overcome financial hardships when they need money the most.

The app provides fast and convenient access to funds in times of emergency. It caters specifically to low-income people who need instant cash without the need for paperwork and collateral.

How does Moca Moca loan work?

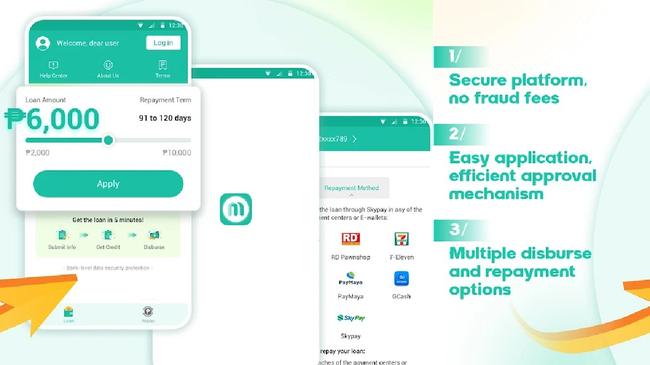

With Moca Moca, instant cash is just a click away. Download the Moca Moca loan app from theGoogle PlayStore or Apple AppStore. Once you have registered, you can apply for small loans of up to P10,000.

The Moca Moca loan application process can be completed in minutes with only minimal documentation. It takes the stress out of submitting documents to prove that you are not a credit risk to them.

Complete the loan application form and submit it. Wait for the approval. Typically, loans are approved in just a few minutes. Once approved, the loan amount will be disbursed into your bank account.

How can I apply for a loan with MocaMoca?

Moca Moca app lending requirements are very minimal:

- You must be a Filipino citizen and at least 18 years old.

- You must have at least one valid ID with a photo.

- Passport, driver’s license, and other government-issued IDs are required as proof of your identity.

- Other requirements include a phone number and e-mail address.

If you meet the criteria and have the documents, you’re eligible and can apply right away.

How much does MocaMoca loan?

The minimum loan amount you can borrow from the Moca Moca app is P2,000 while the maximum is P10,000. These are small loans that you can pay off within a specified number of days. According to MocaMoca, the shortest repayment term is 91 days and the longest is 120 days. If they are being truthful, then this is better than what traditional loan sharks typically offer.

The annual interest rate is set at 10-20%. This is the typical interest rate for online loan apps and may even be a little bit on the low side, in comparison to well-known cash loan apps.

But here’s the catch, there is a one-time service fee of 10%, which is quite hefty.

Say, you borrowed P5,000 and you have 91 days (3 months) to pay it back. Here is the computation:

- Cash loan: 5000

- Service Fee: 500 (5000 x 0.10)

- 10% Interest: 124.66 (5000 x 10% x 91/365)

So,

- The amount you’ll receive is: 4500

- The amount you’ll pay per month is: 1708.22

- The total loan amount including interest: 5124.66

Make sure that you are agreeing to the interest rate and repayment term that you can comfortably pay on time. Otherwise, you should rethink your plans to borrow and check your financial capacity before applying for a loan. If you miss any payment, you might be charged late fees.

How to pay my Moca Moca loan?

Loan payments can be made through online channels like GCash and PayMaya. You can also pay offline through payment centers like 7-11, M Lhuillier, RD Pawnshop, etc.

Is Moca Moca legit?

Yes, MocaMoca is a legit online lending app that’s registered with the Securities and Exchange Commission under the company name Copperstone Lending Inc on May 6, 2021. It’s worth mentioning that the company is also doing business under the following names:

-

QuickLa

-

PocoCash

-

Blue Peso

-

Peso Forrest

-

PesoBuffet

-

Loan Cash

Evidently, Moca Moca is a new player in the online lending space. There may not be enough feedback to help you make an informed decision on whether to avail of MocaMoca’s cash loan offer.

Moca Moca app

The official Moca Moca app can be downloaded from the Play Store or the App Store, depending on your phone’s OS. With its simple, easy-to-use interface, you can intuitively navigate the Moca Moca online app with no problem. You’ll see the loan amount, terms, and other pertinent information.

You might be tempted to download Moca Moca APK, but it’s not recommended. APK stands for Android Package Kit and is a tool that allows anyone to access the contents of an app, which could include advertising and tracking software, or worse a virus. With this information, hackers can gain access to personal information and data if the user is not careful with their phone.

It’s important to keep in mind that Moca Moca loan APK download can pose a serious security threat. Someone with malicious intentions could modify the APK and use it for nefarious purposes. Your personal information is at risk, so stay away from Moca Moca loan APK.

- You can download the MocaMoca app from the Google Play Store here.

Moca Moca Customer Service

MocaMoca’s phone number is not available, and they do not have a website. Although they have an e-mail address, it’s not a company email. The best way to communicate with them is through the agent who handles your account. They will call or text when the payment due date is fast approaching.

-

Phone number: not provided

-

Email address: marrystarone@hotmail.com

Moca Moca Complaints

Looking at the Moca Moca loan app review section in both Google Play and the App Store, it’s evident that many customers are not happy with their experience in using the app. It appears that MocaMoca is not being 100 percent truthful in their marketing.

The most common complaint is that the loan repayment term is only 7 days, instead of the advertised 91-120 days. Borrowers are said to be left struggling to pay their loans in such a short amount of time. And when they fail to pay on the due date, they get repeated calls from debt collectors demanding payment.

Furthermore, there are additional fees deducted from the principal amount. They are said to be technical fees. So, if you borrow P2,000, you’ll only receive P1,400 net of service fee and technical fee.

Although many users of the app have had terrible experiences, it doesn’t mean that you’ll have one too. What this should tell you is that before you apply for a loan, make sure that you read and understand the fine print.

Moca Moca reviews

The reviews for MocaMoca are generally bad because of misleading information about the repayment terms. However, it’s only fair to point out that using Moca Moca has a good side too. MocaMoca approves loans almost instantly. This helps tremendously if you’re in a financial tight spot and you need access to funds fast.

With the emergence of online lending apps, there has been an increased risk of falling into false marketing tactics, resulting in individuals failing to pay their loans. Lending companies may not always be honest with their customers about the terms of the loan, so it’s up to you to do your due diligence before making a decision.

Have you used the MocaMoca loan app? Share your experience here.