What is Mr Cash?

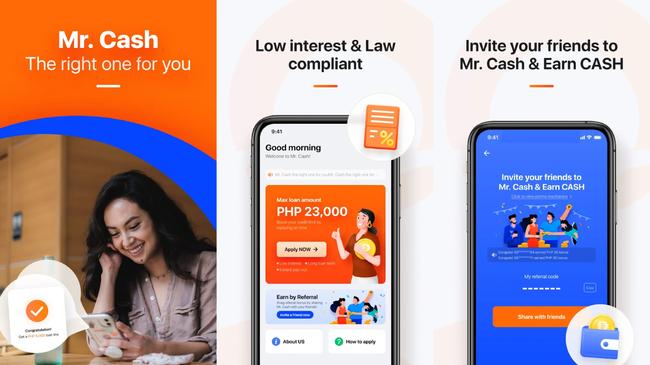

Mr Cash is an online lending app owned by e-Generation Lending Corporation, a fintech company operating in the Philippines. The app is part of the company’s mission to provide accessible loan and credit services to the unbanked and underserved population in the country.

Through its lending app, Mr Cash provides a platform for Filipinos to get quick cash when they need it. The funds can be used in a variety of purpose, including as capital for business. It’s particularly helpful in times of financial hardships when people need funds to tide them over until the next paycheck.

Mr Cash offers a quick and convenient alternative to banks and credit card companies as there’s only minimal requirements and anyone with a smartphone can avail of a small loan.

Mr Cash loan, how does it work?

As an online lending app, Mr Cash streamlines the lending process so that borrowers can be approved for loan in minutes. To initiate the loan process, you must download the Mr Cash app from the Google Play Store. This requires registration using your mobile phone number.

After filling out the application form, Mr Cash will show you the maximum loan amount that you can borrow, the interest, additional fees, and the loan term. If you’re ready to borrow, you just need to continue with the application and provide additional information including references and disbursement options. After submitting the loan application, you just need to wait for the approval.

Interest rate

The published interest rate for Mr. Cash loan, according to SEC documents, is 60% per year. This rate is considered on the high side. It makes the loan even more expensive because it has a 15% service fee. This fee is deducted immediately to the principal, so expect to get less than your expected loan amount.

Is Mr Cash legit?

Yes. Mr Cash is legit in the sense that it is operated by a fintech company that is registered and allowed to do business in the Philippines. This means that the company has followed all of the necessary steps to be considered a legitimate financial institution in the country.

How much is the Mr Cash loan?

Mr Cash offers loan amounts ranging from PHP1,000 to PHP23,000. First-time borrowers are typically approved for PHP1,500. However, if you pay your loan on time and you’ve established a good credit standing, Mr Cash will increase your credit limit on your subsequent loans, and you may even be offered the maximum amount.

Is Mr Cash SEC registered?

Yes. The fintech company behind Mr Cash is called e-Generation Lending Corporation and it is based in Pasig City, Philippines. The company has been operating since 2019, and it is registered with the Securities and Exchange Commission (SEC) of the Philippines, which allows it to operate as a money lender in the country.

Mr Cash loan benefits

Here are some of the advantages of getting a cash loan from an online lending app like Mr. Cash.

-

Quick and easy application process: With most online lending apps, you can apply for a cash loan in just a few minutes. All you need to do is provide some basic information about yourself and your finances and a valid ID.

-

Convenient repayment terms: You can choose your own repayment terms. This means that you can repay the loan on your own schedule, making it more convenient for you.

-

Fast funding: Once you’re approved for a cash loan from Mr Cash, the funds will be deposited into your account quickly.

-

Minimal documentary requirements: Mr Cash only requires 1 valid photo ID and some information about you and your source of income.

-

No collateral and no guarantor: Mr Cash offers unsecured loans, which means you don’t need to use your home, car, or other properties as collateral in the event that you are unable to pay your loan.

Mr Cash loan, how to apply?

To apply for a Mr. Cash loan, you must first download the app and create an account by registering your mobile phone. You will need to enter the OTP code that was sent to you so that you can proceed with the application.

You will be prompted to fill out the application form, which asks for personal and work information. You’re also required to submit a valid ID.

Once all the necessary requirements and documents are submitted, the app will determine your maximum loan amount. It will also show you loan term options of 18, 30, and 45 days. The 45-day loan term will only activate on your next loan.

If you are happy with the terms and conditions, you can submit the application. Loan approval typically takes a few minutes, especially when all information checks out. However, for new applications, it may take up to 3 hours for Mr Cash to review your loan.

Requirements

-

Must be a Filipino citizen

-

Must be 18 years old and above

-

Must have a job or regular source of income (employed, self-employed, business)

-

Must have one (1) valid government-issued ID

-

Driver’s License

-

Passport

-

SSS

-

UMID

-

TIN

Mr Cash loan, how to pay?

You can pay your Mr Cash loans through the app, online and mobile banking, over-the-counter banks, and other authorized payment centers.

What happens if you can't pay?

If you're unable to pay your loan, you will be charged a 1% late payment fee and additional interests. Mr Cash Philippines may choose to pursue collections, which could involve hiring a collection agency. You can also expect multiple calls each day from collectors.

If the debt is not paid, the lender may then choose to file a lawsuit. If the lawsuit is successful, the lender would be able to collect the money owed through wage garnishment or seizure of assets.

Mr Cash app

Mr Cash PH app is available for Android phones, and it can be downloaded from the Google Play Store. The app is not available for Apple iPhones.

-

Mr Cash app download: The app is available for download at the Play Store

-

App APK: It’s not recommended to download Mr Cash APK. Because Mr Cash loan APK files can be accessed and downloaded from anywhere on the internet, they present a risk to Android users.

Here’s why you should avoid downloading APK files:

Malware: Many APK files contain malware that can infect your device and steal your data. Even if you think you’re downloading a legitimate app from a reputable source, it could be infected with malware.

Security Risks: APK files bypass the security checks that Google puts in place for Android apps. This means that any malicious code in an APK file could potentially infect your device without you knowing it.

Legal Risk: Some APK files may be pirated copies of paid apps.

-

Mr Cash Website: Visit https://www.mrcash.vip for loan application details and more information about Mr Cash app.

Mr Cash, customer service

Hotline:

-

09690678937 (Smart)

-

9159589713 (Globe)

E-mail:

- contact@mrcash.vip

Mr Cash, harassment and complaints

There are appears to be no reports or complaints about aggressive collection methods or harassments from Mr Cash loan agents and debt collectors. One of the main complaints is that application for a higher loan amount is often rejected.

Mr Cash loan, reviews

Mr Cash has an average rating of 4.8 stars, which makes it one of the highest rated online lending apps in the Play Store. The high rating is largely due to the easy application process and quick approvals. Borrowers also praise the loan terms because they are true to what was published.

On the downside, some borrowers are not happy with their loans not being approved. This pertains to applications for higher or maximum loan amount. Even frequent borrowers get declined and the only reason the customer support provide is that the decisions are system-generated.

Overall, Mr Cash is a good option for people who don’t qualify for bank loans or credit cards. It’s also good for those who have bad credit or no credit history.

Have you used the Mr Cash loan app? Share your experience here.