What is Online Loans Pilipinas or OLP?

In the emergence of fintech platforms online, one of the pioneer financial institutions to keep up with this trend is Online Loans Pilipinas or OLP established in 2015. This online lending solution based in the Philippines aims to cater to the lack of financial capacity of Filipinos, allowing you to borrow Php 1,000 – Php 20, 000.

Through OLP, you can borrow money anytime in just a matter of hours. Any purpose of borrowing is accepted but mostly focuses on online micro and consumer financing. Your solution to the financial dilemma is now convenient and digitalized.

How does Online Loans Pilipinas or OLP work?

With almost everything being digitized, even financial lending can be done online and avoid over-the-counter transactions. Online Loans Pilipinas or OLP is a fast, transparent, and convenient financial solution to uplift the monetary needs of Filipinos. Very useful, right? You just need a good internet connection and a mobile phone or computer and you’re good to go.

In times of crisis, Online Loans Pilipinas is the website to go to. It offers short-term loans to Filipinos with the lowest interest rates among online financial solution providers and without the need for collateral. Just visit https://olp.ph/en/about-us to learn more about OLP.

How can I apply for a loan with Online Loans Pilipinas or OLP?

To proceed with the loan application with Online Loans Pilipinas, you need to access the official website of OLP, https://olp.ph/ , then you can now proceed to the 4 easy steps of borrowing money online.

Here are the 4 easy steps to successfully borrow money from OLP:

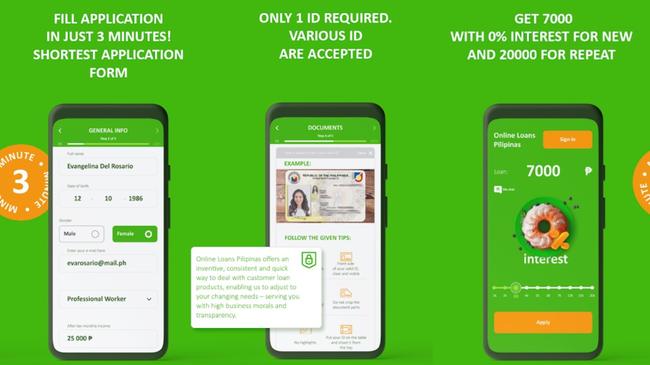

- Apply for a loan and fill out necessary information in just 3 minutes.

- You need to wait for the loan approval through SMS or call from a company representative.

- After being approved, you can now get your money through InstaPay.

- Lastly, make sure to make on-time repayments to avoid unnecessary penalties and additional charges.

Requirements

- Age 22 to 70 years old

- Living in the Philippines

- Employed with a stable income

- Government-issued ID

- A valid bank account or E-wallet account

How much do Online Loans Pilipinas or OLP loans?

In terms of borrowing amounts, Online Loans Pilipinas can offer Filipino borrowers Php 1,000 up to Php 30,000. The amount depends on whether you are a first-time borrower or a repeat borrower. For first-time borrowers, they are allowed to borrow from Php 1,000 up to Php 7,000 only. If this is not your first time borrowing, you can avail of loans up to Php 30,000.

Since it is a short-term loan, the repayment period usually runs from 90 to 180 days or 3 to 6 months depending on your choice of convenience.

Interest Rates:

-

For first-time borrowers, there is a 0% interest and no processing fee loan

-

For repeat borrowers, there is a 1% interest per day and a maximum APR of 200%.

A gentle reminder for repeat borrowers, interest rates vary depending on your loan amount as well as the terms and conditions. You can visit https://olp.ph/ and check their OLP calculator for accurate amounts and information.

How to pay my Online Loans Pilipinas or OLP loan?

Just as convenient as the application for loans, the same convenience applies in making loan repayments which can be processed in numerous authorized repayment outlets nationwide.

Here is the list of authorized OLP repayment outlets:

-

7-Eleven

-

PayMaya

-

Bayad Center

-

Coins.ph

-

Cebuana Lhuillier

-

LBC

-

GCash

-

SM Department Store

-

RD Pawnshop & Jewelry

-

Robinsons Business Center

-

Palawan Express

Is Online Loans Pilipinas or OLP legit?

Through the years of serving and uplifting Filipinos, Online Loans Pilipinas or OLP cannot do that without an appropriate license to operate from the Philippine government agency, which is the SEC or Securities and Exchange Commission.

Online Loans Pilipinas or OLP’s SEC Registration number is CS201726430. Its Certificate of Authority number is 1181. The above information only proves that OLP is a legitimate online lending solution. You can be at ease that your information and loan repayments are safe and are in good hands.

Online Loans Pilipinas or OLP Mobile Application

Made to ease and bring access to all, OLP launched its mobile application which can be found through the Android play store. Download now at https://play.google.com/store/apps/details?id=ph.onlineloans.mobile.android&hl=en_US&gl=PH and avail a 0% interest on your first loan, and can borrow up to Php 7,000 on your first time.

OLP Customer Service

For any concerns regarding your loan application and repayments, you may reach their customer service hotline through the following contacts.

Phone Number:

-

(02) 405 5171 or (02) 231 3536 (9am-11pm from Monday to Saturday)

Email Address:

OLP Complaints

One unavoidable circumstance in doing business online is facing the complaints of customers. Here are some of the complaints of the users of OLP from different social platforms.

Some of the users say that OLP does not provide them the freedom to choose whether to accept or reject the loan proposal. What happens is that the system automatically sends you the money and deducts some charges. Later on, inform you about the details of the loan.

Customers of OLP have been having issues regarding the frequent calling of the company representative even though the loan repayment is far away from its due date.

Several customers are being confused because of the unmatching information on the application and the company representative, the representative states that repayments can be done on or before the due date, but the application states it should be paid none other than the date of the repayment.

OLP Reviews

Despite having complaints from a minority of its customers, OLP still received positive reviews from first-time customers and repeat borrowers. The online lending company received a 4.61/5 rating from the All the Best Loans website. A 4/5 review from Google play store application users. Lastly, a 4.3/5 rating from reviews in FastLoans.ph.

Some of the customer reviews say that OLP is “A fast and legit online lending company, can easily get disbursement”, and “very reliable and fast approval” for its positive reviews. On the contrary, some of the opposite reviews are “having trouble reaching the customer service representative”, and “charging higher interest rate on the second and third loan application”.

No matter what the reviews are, as long as OLP is continuously addressing the issues and concerns. It still has its ways to earn the public’s trust and interest.

Have you used OLP Loans? Share your experience here.