What is Pera Bag?

Pera Bag is an online lending app that offers Filipino borrowers a more convenient way to get access to small, short-term loans. It’s designed to help people who need quick cash for emergencies, bills payment, debt servicing, or unexpected expenses.

The app is owned and operated by Got-IT Lending Inc., a fintech company that runs other loan apps, such as Eagle Wallet and Pera U Bag.

The company acknowledges that traditional payday loans can be difficult to obtain, often requiring borrowers to visit a physical location and fill out a lengthy application. Pera Bag streamlines the process by allowing users to apply for a loan directly from their smartphones. It’s perfect for those who are not qualified to get loans from traditional lenders like banks and credit companies.

Pera Bag loan, how does it work?

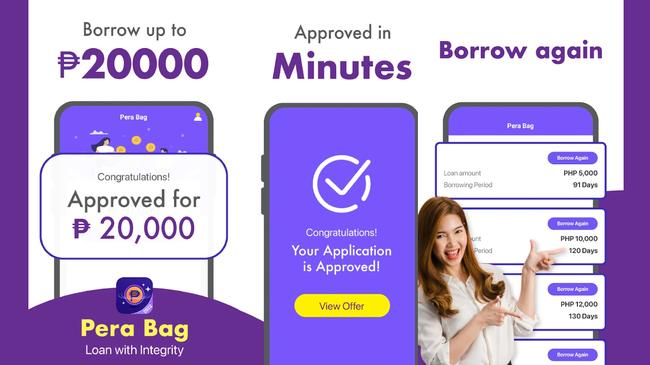

Pera Bag’s loan application process is so streamlined that it only takes a few minutes to complete the application from registration to approval. You must first download the app from the Google Play Store.

After creating an account, you just need to fill out the online application form, indicate the amount you want to borrow, submit the form, and wait for the approval. If approved, you will be notified via text message or push notification.

Interest rate

Pera Bag offers an interest rate of 5% per month. However, the loan term is only 7 days. Keep in mind that there will be other charges that are deducted from the principal amount. The app will give you a breakdown of your loan, including the interest and charges, before you submit the loan application. This gives you the option to cancel if you don’t agree with the terms of the loan.

Is Pera Bag legit?

Yes. Pera Bag is a legit online lending app. It’s operated by Got-IT Lending Inc., a company that’s relatively new in the market, having been registered only in 2019.

How much is the Pera Bag loan?

The minimum loan amount you can borrow is PHP3,000 and the maximum is PHP20,000. Expect to be offered a small amount on your first loan. If you have established yourself as a responsible borrower who pays on time, you’ll be given a higher loan amount on your next loan application. So, make sure to build a good credit standing with Pera Bag to enjoy the highest loan amount.

Is Pera Bag SEC registered?

Yes. Pera Bag is registered with the Philippines Securities and Exchange Commission (SEC) under Got-IT Lending Inc. It was registered and given the Certificate of Authority (CA) to operate as a lending company on June 19, 2019.

Pera Bag loan benefits

-

Pera Bag loan is an unsecured personal loan that does not require collateral or a guarantor.

-

Pera Bag makes it easy for Filipinos to get a loan by only requiring 1 valid ID. No paperwork is needed.

-

The application process is fast and can be completed in less than 10 minutes.

-

Because the screening process does not rely on credit scores, the loan approval is lightning fast.

-

Once the loan is approved, the cash is released to your endorsed account within 24 hours (but usually within minutes).

Pera Bag loan, how to apply?

To apply for a Pera Bag loan, download the app from the Play Store. Register your mobile phone and wait for the OTP. On the dashboard, you’ll see the maximum loan amount that you can borrow as well as the loan term. It will also display the repayment amount.

Fill out the online loan application form. Provide personal and financial information. Upload a valid ID when prompted. Submit your application and just wait for the approval. This usually takes only a few minutes.

Once you get your approval, the cash will be disbursed to your bank account or e-wallet. You can also pick up the loan from authorized remittance centers.

Requirements

-

You must be a Filipino citizen.

-

You must be at least 20 years old.

-

You must have one (1) valid government-issued ID.

Pera Bag loan, how to pay?

You can pay your Pera Bag loan through online banks, over-the-counter banks, payment centers, and other authorized payment partners.

What happens if you can't pay?

If you can't pay your loan from Pera Bag, you will be charged a late payment fee, additional interest, and other associated fees. If you continue to miss payments, Pera Bag may endorse your account to a third-party collection agency.

You can expect incessant calls from debt collectors, who sometimes resort to aggressive collection methods that border on harassment and threats.

To avoid these stressful scenarios and serious financial consequences, make sure to review and understand the terms of your loan agreement before taking out a loan. If you think you can’t afford the monthly payments, it’s best not to borrow money from Pera Bag.

Pera Bag app

The entire Pera Bag loan application process happens in the app. The app has a minimalist design, with only the essential information displayed on the screen. It has a user-friendly interface with intuitive design, making navigation quick and easy.

App download

Pera Bag is available for Android phones. The app can be downloaded from the Google Play Store. It’s not available in the Apple App Store.

Pera Bag, customer service

-

Hotline: Pera Bag does not disclose its Hotline. If you want to contact customer service, you can e-mail Pera Bag at dfd345gh@gmail.com .

Pera Bag, harassment and complaints

Lately, online lending apps have come under fire for aggressive collection practices. Some Pera Bag borrowers have lodged their complaints with the National Privacy Commission, citing that they have been inundated by calls, SMS, and e-mail messages from debt collectors, often multiple times a day.

Some agents even go so far as to call borrowers’ employers, friends, and family members in an attempt to collect on the debt. This type of behavior is not only harassing, but also illegal.

It is believed that many online lending apps are using personal information beyond their intended purpose, thereby violating the data privacy laws.

Pera Bag loan, reviews

The Pera Bag loan app has a positive review on Google Play Store with a rating of 4.6 stars. Although it’s one of the highest-rated online lending apps in the store, it’s not without its issues. In terms of the performance of the app, there are no major complaints as all the functions and features work as intended.

Pera Bag’s quick approval process is perhaps the biggest strength of this online lending service. However, this may be eclipsed by some negative feedback relating to short loan terms and unacceptable collection practices. Borrowers complain about being harassed by debt collectors who threaten to expose them on social media, which causes fear and humiliation. If this is something you don’t want to deal with, you’re better off going the traditional route with banks and credit cards.

Have you used the Pera Bag loan? Share your experience here.