Loans are the most important financial instrument for individuals in need. They allow them to make ends meet, pay bills, and cover living expenses.

On the other hand, loan providers like Pera247 are often offer flexible repayment options, which means that it can be easier for borrowers to repay the loan on time and avoid defaulting on their loan. In addition, lenders often offer lower interest rates than other lenders which makes it easier for borrowers to repay the loan with less money out of pocket.

What is Pera247?

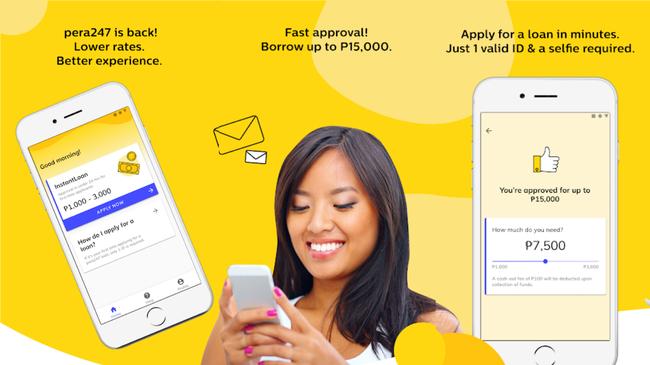

Pera247 is an organization that provides fast loans to Filipino people, especially those in need of money immediately. The best part is the borrower is not required to explain as why he/she needs the money. So whether it’s for medical services, travelling, or education, just fill out their online form and get a quick transaction of Pera246 cash loans.

How does Pera247 works?

With the help of your phone, you can easily access your account on their app and choose the amount of loan you want. Their app is available on Google Play Store. If you successfully submitted your application and effectively got a loan from Pera247, they will receive your full information and will remind you of how much and when you need to pay back. Normally, you have 18 days to repay the loan, especially if you are a first time borrower. But if not, Pera247 can give you 90 days to repay.

Their system will also be reminiscent on when you need to pay the permanent contributions. This is to make a unique opportunity to everyone and teach existing clients the basics of financial literacy and management.

How can I apply for a loan with Pera247?

- Once downloaded from Google Play Store, open the app and register using a valid phone number.

- Fill out the registration form, upload a photo of your valid ID, and take a selfie.

- Make sure that you carefully reviewed all the information you input. It is also required to allow Pera247 to access your mobile data since that’s how they will check if your credit should be approved.

- Once you are registered on the app, you can now apply for a loan. To get one, tap “InstantLoan”.

- Answer a few questions made exclusively by Pera247.

- Choose the loan amount you prefer and the payment terms and conditions.

- Verify your identity.

- Finally, you can get your money once it’s approved. Get the cash to their over 10,000 partnered outlets nationwide.

How much is Pera247 loans?

The maximum amount of money you can borrow on Pera247 is PHP 15,000. While the interest rates are no more than 6%. They also have a processing fee of PHP 100 to 500 depending on the amount of loan.

To give you an example, if your loan amount if PHP 10,000, Pera247 will give you 30 days to repay it. The interest of the said amount is PHP 600 (6%) and the processing fee is PHP 300. Overall, you have to repay PHP 10,900 within 30 days. You can pay it back gradually or full.

How do I pay my Pera247 loan?

Repaying your loan in Pera247 is just like how you pay any other monthly bills. It can also be completed through the following outlets nationwide:

- Gcash outlets or app

- 7-eleven Cliqq Kiosk

- MLhuillier

- Cebuana Lhuillier

- Bayad Center

- SM

- True Money

Just make sure that you have your reference number, mobile number registered, and the total amount you have to pay. Once done, your payment will automatically be updated on Pera247 app within 24 hours. If your loan is fully paid, the loan status on the app will mask as ‘closed’.

Keep in mind that you should pay on time to avoid penalties. Also, keep your copy of payment receipt/s until your loan status is closed. More importantly, never provide you password, one time pins, or verification codes to anyone – even if they said that they are personnel from Pera247. Remember that the latter will never ask that kind of information.

Is Pera247 legit?

Pera 247 is a financial company that works in the Philippines under SEC or Securities and Exchange Commission. Therefore, they abide the law to receive appropriate permission and provide fast loans to people.

Pera247 is legit since you can find it on the official website of sec.gov.ph wherein there’s a legitimate list of companies that are trustworthy, certified, and authorized.

To view the list, click on these links:

- https://www.sec.gov.ph/lending-companies-and-financing-companies-2/list-of-lending-companies-2/

- https://www.sec.gov.ph/lending-companies-and-financing-companies-2/list-of-financing-companies/

Pera 247 app

Pera247 has a user-friendly interface and easy to download app. It’s available to download on Google Play Store or get the Pera247 apk through this link: https://apkcombo.com/pera247-online-cash-loan-app/versluisant.kredit24/

Pera247 customer service

If you wish to contact Pera247, you can send them a private message on their social media accounts below:

- Facebook: https://www.facebook.com/pera247

- Instagram: https://www.instagram.com/pera247app/

Or you can reach them via:

Contact Numbers

-

09219610721

-

09273348368

Pera247 complaints

There are several complaints about the Pera247 because of its inconveniency caused by the system upgrade. Many said that the app is not accepting their passwords, once they clicked the option ‘Forgot Password’, they will contact to get a reference number for the app. But no e-mails arrived and Pera247 seems to overlook the situation when it comes to sending updated e-mails.

Pera247 reviews

Despite of the email issue complaints, many people are grateful for the fast loans provided by Pera247. It is stated that when someone needed a little help, Pera247 is to the rescue. Also, a lot of people are comfortable in doing business with the app. Meaning, Pera247 has bearable terms and conditions to borrowers. The application and approval process are also easy, and the customer service turnaround is quick.