What is Right Choice Finance?

Right Choice Finance is an online lending platform in the Philippines that was created to provide financial services to businesses and individuals who would not normally have access to traditional banking services.

Established in 2016, Right Choice is a wholly owned subsidiary of Singapore-based Right Choice Capital, a major finance company that supports micro, small, and medium enterprises (MSMEs) in Southeast Asia.

With its app, Right Choice is able to reach people living in rural areas, low-income earners, and underserved communities. Loan services are currently available within Metro Manila, North and South Luzon, and Cebu.

Right Choice offers different financial products for its customers, including business and personal loans. The company understands the needs of its customers, and it provides them with the best possible solutions based on their financial requirements.

Right Choice Finance loan, how does it work?

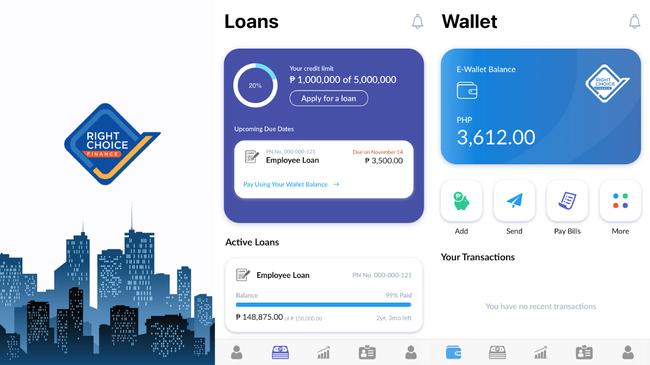

Right Choice financial products and services can be accessed on the myRightChoice mobile app. Personal loan applications can be done through the app in just a few taps. The simple application process makes it easier to get the funds borrowers need without having to leave home.

Borrowers just need to download the app, create an RCF Wallet account, select the type of loan, fill out a loan application form, and upload the documentary requirements. Upon approval, the funds will be disbursed to the RCF Wallet.

Interest rate

Right Choice personal loan interest rates can vary from 1.5% to 5% per month or 11.88% to 60% per annum, depending on the risk assessment level of each borrower. Higher interests are charged to borrowers who are considered a credit risk.

On top of the interest rate, Right Choice charges the following fees:

-

Processing fee: 5%

-

Documentary stamp: 0.75%

-

Insurance fee: based on loan amount and term

-

Notarial fee: PHP200 per loan

Is Right Choice Finance loan legit?

Yes. Right Choice is a legit finance company authorized to do business in the Philippines. In addition, being a wholly owned subsidiary of Right Choice Capital Pte. Ltd. gives it credibility and trustworthiness.

How much is the Right Choice Finance loan?

You can borrow loan amounts anywhere from PHP20,000 to PHP3 million. The amount you are eligible to borrow will depend on your credit score, income, employment history, and other factors that go with Right Choice’s credit review process.

Is Right Choice Finance SEC registered?

Yes. Right Choice Finance Corp. has been registered with Securities and Exchange Commission (SEC) since June 10, 2016. It has a Certificate of Authority to operate as a financing and lending company.

Right Choice Finance loan benefits

-

Right Choice Finance Philippines offers flexible loan options for those seeking an easy and convenient way to finance their next business venture or simply pay unexpected expenses.

-

Unlike traditional bank loans, Right Choice Finance offers a streamlined application process with no hidden fees or complicated paperwork. Loan applicants who meet basic criteria such as having a good credit score and stable income can be approved quickly and with no delays.

-

Once approved, borrowers can customize their monthly payments based on their individual needs and budget constraints. This makes it much easier to manage their financial obligations without sacrificing other important areas of life.

Right Choice Finance loan, how to apply?

The application process is quick and easy, simply download the app, create an RCF Wallet account. Once verified, select the type of loan you wish to avail (e.g., personal loan). Upload the documentary requirements to the app and then submit.

Once your loan application has been submitted, Right Choice Finance will review your information and offer a decision within 24 to 48 hours. If approved, the money will be deposited to your RCF Wallet.

Requirements

-

You must be a Filipino citizen.

-

You must be 20 to 60 years old upon loan application.

-

You must have a regular full-time job for at least a year.

-

Documentary requirements:

-

Certificate of Employment

-

Payslip (latest 3 months)

-

Proof of address or proof of billing

-

2 valid government-issued IDs

-

Location selfie (with residence façade and house number as background)

-

6 months bank statements (via BRANKAS or manually uploaded)

-

Post-dated checks (PDCs)

Right Choice Finance loan, how to pay?

You can easily pay your loan via the RCF Wallet. Make sure that it has enough funds to cover the loan amount due for the period.

What happens if you can't pay?

If you cannot meet your payment obligation as outlined in the loan agreement, you must contact your dedicated Right Choice account manager ahead of your due date so that they can work with you to find an appropriate solution. This could include extending the term of the loan or creating more flexible payment arrangements that suit your financial circumstances better.

If you’re unable to make any payments for an extended period of time due to financial hardship, Right Choice may resort to legal actions to collect money from you.

Right Choice Finance loan app

The Right Choice app is available now in both the Google Play Store and Apple App Store and can be downloaded free of charge. Search for “MyRightChoice” on the Play Sore and “MyRCF” on the App store to make sure you get the right mobile app.

Loan applications are all done in the app, so there are long waiting times and the whole process can be completed online in minutes. The app also offers extra features such as payment reminders, so you never miss a payment deadline, and helpful resources for better understanding financial products.

With its easy-to-use interface, you can access a variety of services from a single platform. From insurance to banking to investment to loans, MyRightChoice has all the tools you need to manage your finances with ease.

Right Choice Finance, customer service

-

Hotline: (+632) 843-6057

-

24/7 Chat via the Right Choice website

-

Email: info@rcf.ph

Right Choice Finance, reviews

Right Choice Finance reviews have been overwhelmingly positive. The app has an average rating of 4.8 and 4.6 stars in Apple App and Google Play Store, respectively. The company has a great reputation for providing excellent customer service and financial advice to individuals.

The main complaint though is that the loan process is more tedious than typical online lending apps. It also requires more documentary requirements similar to what traditional banks would ask for. Right Choice is not for everyone, especially those that have poor credit history and have no documents to show. Right Choice operates more like a traditional bank than an online lending platform.

Have you used Right Choice Finance? Share your experience here.