What is Robocash?

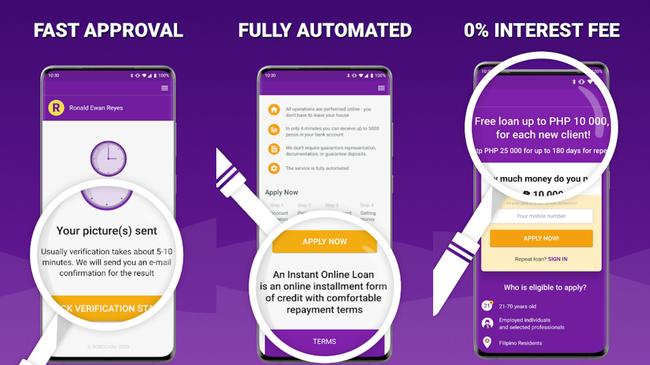

Robocash is an online lending app that operates in the Philippines to provide Filipinos access to quick cash loans. Through the Robocash app, users can apply for a short-term loan and receive the funds within minutes of approval.

The Robocash loan app is designed to make it easy for borrowers to get the money they need, and it offers a simple application process that can be completed in just a few minutes. Robocash also offers competitive interest rates and flexible repayment options, making it a great choice for borrowers who need a quick and easy way to get a loan without collateral and paperwork.

On August 8, 2021, Robocash was renamed Digido Loans. It now operates under the Digido Loans Philippines brand run by Digido Finance Corp.

How does Robocash App work?

Robocash (Digido) provides an innovative and quick way to borrow money without having to go through traditional banks. From the application process to approval, everything happens within the app or online through digido.ph.

You just need to download the app and create a Robocash account. You will need a mobile phone to register. You will be given a code to verify your number. Once verified, the app will guide you through the step-by-step process.

The app will ask for some personal information as well as your job and source of income. After the registration, you’ll be able to see how much money you can borrow and how much interest you have to pay. You’ll also see the repayment terms available to you. If you’re satisfied with the loan terms, you can apply immediately.

How can I apply for a loan with Robocash App?

The Robocash application form is integrated into the app itself. To open an account, you need to download the app and register. To apply for a loan, you'll need to provide some personal information, such as your name, address, and date of birth. You'll also need to provide your employer information or source of funds.

The process is the same if you prefer to use the Robocash online loan application through your browser. Just go to digido.ph, indicate how much money you need to borrow, provide your mobile number and click on the ‘Apply Now’ button.

Requirements

- You must be 21-70 years old.

- You must have a valid ID (e.g., government-issued IDs such as passport, UMID, SSS, driver’s license, etc.).

- A valid mobile phone number.

Once you have registered, you can proceed with the application, specifying the amount of money you need. If your loan is approved, you will receive the funds in your account within 24 hours.

How much does Robocash loans?

Robocash offers short-term loans of up to P25,000. The amount that can be borrowed varies depending on the individual's credit history, source of funds, and other factors determined by the Robocash AI based on the information you provide in your application form. It’s possible that new borrowers will only be approved for a small loan amount for starters. The minimum loan amount is P1,000.

Interest rate for a new loan is very low at just 0.01% per day. However, for repeated loans, the interest can go up to 11.9% per month or an annual percentage rate (APR) of 143%. This interest rate is higher compared to similar online lending apps.

On top of the interest rate, you will be charged with a processing fee and related fees that may not be clearly communicated to you. Make sure you read the terms and conditions or ask a Robocash agent about additional fees before you submit your Robocash loan application.

The loans are typically for a period of 7 to 180 days. This allows you to have more time to pay off loans because you can make smaller payments over a longer period of time. Additionally, it provides a sense of flexibility and allows you to better manage your finances.

Keep in mind that you can only apply for a new installment Robocash loan after paying off your previous loan in full.

How do I pay my Robocash loan?

To pay your Robocash loan in the Philippines, you will need to visit an authorized payment center. At the payment center, you will need to provide your loan number and pay the amount you owe in cash. Your payment will be processed and a receipt will be issued for your records.

Authorized Payment Channels:

- 7-Eleven

- AUB Online

- BDO (Online and Cash Deposit)

- Bank of Commerce Online

- Bayad Center

- BPI (Online and Cash Deposit)

- Cebuana Lhuillier

- Chinabank

- Coins.ph

- ECPay

- LBC

- M. Lhuillier

- RD Pawnshop

- Robinsons (Online, Bank Deposit, Department Stores)

- SM Department Stores

You can find the complete list of authorized payment centers on the Digido.ph website .

Is Robocash legit?

Yes, Robocash service is legit, but it’s not without controversy. Robocash Finance Corp Philippines operates as a financing company. It’s registered with the Securities and Exchange Commission (SEC). However, on December 19, 2019, the SEC revoked the license of the company for running several unauthorized branches all over the Philippines.

On June 30, 2020, Robocash Philippines reopened its branches. It changed its name to Digido and started operating using the brand name in August 2021.

Robocash app

Robocash app download can be used on Android and iOS devices. You can get the Robocash app for iPhone on the App Store, while the app for Android phones is available on Google Play.

Beware of Robocash APK download sites. Although using Robocash app APK allows you to install the app on your Android device, it has potential security risks.

Robocash APK download may contain malicious software that can harm your device or steal your personal information. The APK asks for too many permissions, including access to your contacts, messages, and location. This could potentially allow the app's developers to access your info and track your digital movements.

Furthermore, the APK version of the app may not be reliable and may not work as promised as it has not been verified by Google Play.

Robocash customer service

Robocash customer service is there to help you with any questions or problems you may have with your account. They can help you with anything from setting up your account to making a payment. You can contact them by phone or email:

- Phone numbers: (02) 876-8481; (02) 8876 8484 to 89.

- Email address: support@digido.ph

Robocash complaints

Most of the Robocash complaints stem from the high interest rates and additional fees the company charges for its services. Some customers have complained that they were misled about the terms of their loans. Others have alleged that the company engaged in predatory lending practices, charging exorbitant interest rates and fees that made it difficult for borrowers to repay the loan.

Additionally, some customers are unhappy with the amount of time it takes for funds to be transferred to their bank accounts. There were also instances of payments not immediately reflected, resulting in late payment fees.

Robocash Reviews

Robocash app review has an average rating of 4.3 stars on Google Play and 2.3 stars on the App Store. Most of the positive feedback was about how easy it is to use the app. Because of Robocash app’s user-friendly interface, the process of borrowing is simplified. You just need to complete the Robocash online application and upload the necessary documents (i.e., valid ID), and if approved, you will receive your loan within minutes. There are no credit checks or paperwork required, and you can use the money for any purpose you choose.

Many online reviewers have given Robocash positive reviews due to the quick disbursement of the cash loan. It only takes minutes to apply and get approved. Once approved, the money is transferred to your chosen bank or payment method within 24 hours.

Lastly, the customer service team at Robocash is always available to help borrowers with any questions or concerns they may have.

Have you used Robocash? Share your experience here.