What is SB Finance?

SB Finance is the consumer finance arm of Security Bank in partnership with Thailand-based bank Krungsri. It offers a digital financial platform that helps businesses and individuals gain quick access to different types of loans—personal loan, Car4Cash, Hooloogan, and MotorsikLOAN. It also provides customers with a variety of tools to help them better understand their finances and make informed decisions about their money.

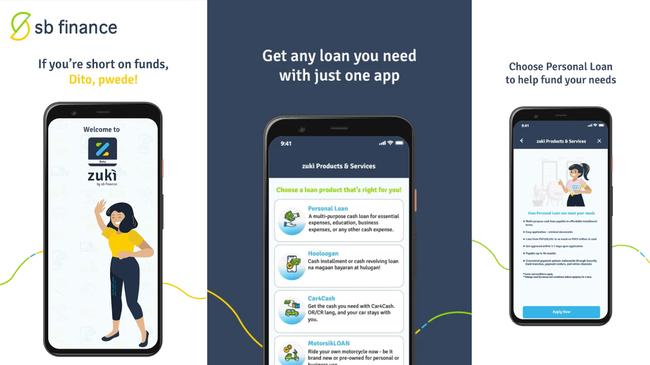

Through its zuki mobile app, SB Finance provides Filipinos a convenient way to apply for loans tailored for a variety of purposes with no collateral required.

SB Finance personal loan, how does it work?

All loan applications are done in the SB Finance app called zuki. You just need to download the app, register, and upload the necessary documentary requirements. Once registered, you can apply for a loan. Upon approval, your money will be disbursed to your preferred bank account through InstaPay or PesoNet.

Interest rate

The interest rate per month is 1.89% with payment terms of 12, 18, 24, and 36 months. The estimated Annual Percentage Rate (APR) at 36 months is 37.53%.

Other fees include:

-

Processing fee — PHP2,000

-

Notarial fee for loans PHP100,000 and above – PHP300

-

Documentary stamps (PHP250,000 and above) – PHP200

How much is SB Finance personal loan?

SB Finance offers loanable amount between PHP30,000 and PHP2 million. This makes it a great option if you are in need of quick financial assistance. The company also offers convenient repayment terms that will suit your needs.

Is SB Finance legit? Is SEC Registered?

Yes. SB Finance is operated by Security Bank, which is the eighth largest privately-owned domestic universal bank in the Philippines. SB Finance Company, Inc. was registered with the Securities and Exchange Commission on August 4, 2017, with a Certificate of Authority to operate as a financing company.

SB Finance is also backed by two big banks—Thailand’s Krungsri (Bank of Ayudhya) and Japan’s MUFG Bank. This is a vote of confidence in SB Finance's business model.

SB Finance benefits

SB Finance is an online loan app that offers a simple and convenient way to get a loan. It is a great option for those who need a loan but don’t have the time or patience to go through the traditional bank loan process or simply are not qualified for a bank loan. Here are some of the benefits of using SB Finance:

-

You can apply for a loan anytime, anywhere. All you need is a mobile phone and an internet connection.

-

The application process is quick and easy. You can get approved for a loan in just a few minutes.

-

There are no hidden fees or charges. You will know exactly how much you need to repay before you even apply for the loan, plus the fees associated with the loan.

-

The interest rates are competitive and you can choose from a variety of repayment options that fit your budget and schedule.

How to apply for SB Finance?

The loan application process is fully digital. Just fill out the SB Finance personal loan application form that is built into the app and upload the documentary requirements.

SB Finance personal loan Requirements

-

Must be a Filipino citizen.

-

Must be 21 years old a at the time of the loan application. Must not be more than 65 years old upon the maturity of loan.

-

Must have a valid landline (residence or office).

-

For employed:

-

Must have a monthly income of PHP15,000 for borrowers from Metro Manila and PHP12,000 for outside Metro Manila.

-

Latest 1 month payslip

-

Latest Income Tax Return (ITR)

-

Certificate of Employment and Compensation

-

For self-employed individuals:

-

Must own at least 40% stake in the company and the business must be profitable for 2 years.

-

Must have monthly gross income of PHP60,000.

-

Must provide trade references.

-

Latest audited financial statements

-

DTI or SEC Certificate of Registration

-

Business permit

-

Latest 3 months bank statement

-

For corporation: latest General Information Sheet (GIS)

Loan calculator

SB Finance has a personal loan calculator on their site and app, which you can use to get an estimate of the monthly payment that you will need to make. Just enter your desired loan amount and the preferred loan term and the SB Finance loan calculator will show you the calculated amount you have to pay per month, inclusive of interest. This can be a helpful way to budget for your loan payments.

How to check SB Finance personal loan status?

If your loan is approved, you will get a notification from the zuki app about the release of the loan. To check your SB Finance loan status, you can contact the 24-hour customer service hotline. You can also send an email or get in touch with agents through their Facebook page.

How to pay SB Finance loan?

You can pay your loans through Security Bank branches, automatic debit arrangement, Security Bank Online and Security Bank Mobile via enrollment.

Alternatively, payments can be made through authorized over-the-counter partner channels:

-

7-Eleven branches

-

CVM Pawnshop

-

Gaisano malls

-

RD Pawnshop

There is a PHP50,000 transaction limit for over-the-counter payments, but you can do multiple transactions if you exceed the limit.

What happens if you can't pay?

If you can't pay your SB Finance online loan, there are a few things that could happen. The first is that SB Finance will charge a late payment fee of PHP500 or 3% of the unpaid amortization, whichever is higher.

If you continue to miss payments, SB Finance may contact you to try and arrange a new payment plan. If you and SB Finance are unable to reach an agreement, your account may be sent to collections. This means that a third-party company will try to collect the debt from you. Finally, if you still don't pay the loan, SB Finance may take legal action against you.

SB Finance app

zuki by SB Finance is the app that facilitates and processes loan applications. The app is available for both iOS and Android devices, and it’s free to download. With its easy-to-use interface and features, the app can help you get a loan, stay on budget, reach your financial goals, and make smart money decisions.

You can download the zuki app from SB Finance in the next links:

- zuki app from Google Play Store.

- zuki app from Apple App Store.

SB Finance, phone and customer service

-

SB Finance Contact Number Hotline: (+632) 8887-9188

-

E-mail:

SB Finance, reviews

SB Finance has a rating of 3.1 stars on the Google Play Store and 2.6 stars on the Apple App Store. As the zuki app is still in beta stage, most of the complaints relate to technical issues like the app crashing and registration problems. Those that successfully got through are generally satisfied with their loan application experience.

Have you used SB Finance personal loan? Share your experience here.