What is Shopee?

Shopee is a mobile-first marketplace that makes shopping convenient and easy for users. It’s a subsidiary of Sea Limited, a Singapore tech conglomerate. Shopee was launched in 2015 in Singapore, Indonesia, Malaysia, Taiwan, Thailand, Vietnam, and the Philippines. Since then, it has become the leading e-commerce platform in Southeast Asia and Taiwan.

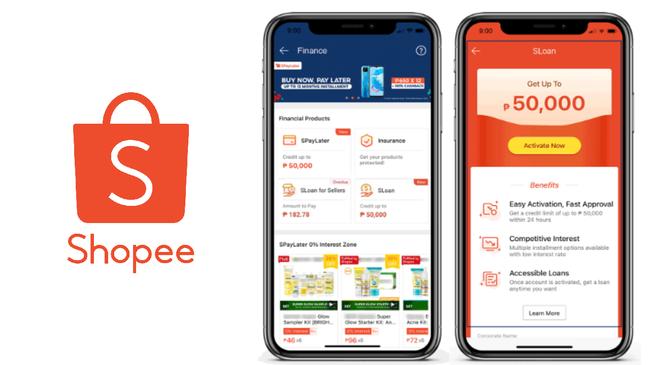

Shopee Philippines offers a wide range of products from electronics to fashion to home essentials from big brands and independent sellers alike. It provides a safe and secure platform for sellers to sell their products. Shopee also offers various payment options, such as cash on delivery, bank transfer, e-wallet, and credit/debit card payments. They continue to add features and services to their platform, including SPay Later and SLoan.

Shopee loan, how does it work?

How to get a loan in Shopee? Shopee offers loan through the platform’s SLoan feature. Eligible Shopee buyers are given quick access to a cash loan with flexible payment terms of 3, 6, 9, or 12 months. This feature is made available to qualified Shopee users.

Once the SLoan feature is enabled, you must activate it before you can avail the cash loan. Shopee will then ask you to review and update your personal information. If everything checks out, Shopee will then give you an initial credit limit.

Shopee Loan Interest Rate

The Shopee interest rate is anywhere from 1% to 5% of the principal amount. The interest rate may vary across different borrowers, depending on the loan amount. There is also an admin fee of 1% of the total loan amount, which is deducted upfront. So, you’ll not get the full amount of your loan because of this fee. The same conditions apply to the Shopee Pay Later interest rate.

How much is the Shopee loan?

As a Shopee buyer, you can avail a loan amount of up to PHP50,000. Shopee uses an internal credit assessment system for eligible buyers, so the initial loan will vary from person to person. Also, the maximum loan amount is likely to be offered to repeat borrowers with good credit standing with Shopee.

Shopee loan benefits

Availing of a Shopee loan for buyers comes with benefits that include the following:

-

Easy application process. You don’t have to submit any documentary requirements because the loan is pre-approved based on the information you have provided to Shopee when you first joined.

-

SLoan will automatically be made available to you when you are active on Shopee as a buyer. So, if you’re a regular shopper in the platform, there’s a higher chance for Shopee to extend the credit facility to you.

-

Shopee loans offer low interest rates, making them a good option for borrowers who are looking for affordable financing.

Shopee loan, how to apply?

Shopee determines which Shopee users are eligible for the SLoan. If you are qualified for the loan, it will automatically show up on the app dashboard.

How to avail your Shopee loan?

Wondering how to loan on Shopee? To avail of SLoan, you must be a registered user of Shopee app. If you're not yet registered, you can do so by creating a Shopee account on the Shopee app or the website. Your eligibility will be based on your activities.

The more you shop in the Shopee platform, the more likely the loan features will be made available to you. Shopee’ algorithm will determine the maximum loan amount that you can borrow.

Requirements

-

You must be a Filipino citizen.

-

You must be at least 21 years old.

-

You must have a valid government-issued ID to activate the SLoan feature.

-

Passport

-

UMID

-

Driver’s License

-

PRC ID

-

Phil ID

-

Postal ID

-

You must have an activated ShopeePay account where the money will be disbursed.

Shopee loan, how to pay?

Shopee will send reminders days before the due date of the loan. To initiate payment, you have to tap SLoan and then the current repayment info will be displayed. Tap the Pay Now button and you’ll see the different payment options:

-

Payment Centers

-

7-Eleven Cliqq

-

M Lhuillier

-

SM Bills Payment

-

Cebuana Lhuillier

-

Robinson’s Department Store

-

Palawan Pawnshop

-

E-Wallet

-

GCash

-

Coins.ph

-

ECpay

-

Over-the-Counter or Online Banking

-

BDO

-

EastWest

-

Metrobank

-

Chinabank

-

BPI

-

PNB

-

RCBC

-

Unionbank

-

AUB

-

Robinson’s Bank

-

Landbank

-

Security Bank

-

UCPB

-

Bank of Commerce

Shopee loan installment

Shopee loan can be repaid over time with a set number of payments. Shopee offers loan terms of 3, 6, 9, and 12 months. The 12-month Shopee loan instalment is offered to eligible Shopee users only.

An installment loan can be a great option if you need cash fast but don't want to take out a large loan all at once. With an installment loan, you can make smaller payments over time until the loan is paid off. This can make it easier to budget for your loan and make timely payments.

If you're considering Shopee loan installment Philippines, compare interest rates and terms from different lenders before borrowing. And always make sure you can afford the monthly payments before taking out any loan.

What happens if you can't pay?

If you miss payments, you will be charged a late fee that will applied to the total overdue amount. If you can’t pay your SLoan, Shopee can suspend your Shopee account and you will no longer be able to use the app.

Non-payment of a loan can also damage your credit score and make it difficult to get loans in the future using the app.

Shopee app

The app can be downloaded from the Google Play Store and the Apple App Store.

The mobile app is easy to use and has a user-friendly interface. You can create an account for free and start buying and selling products within minutes. More features can be unlocked as you keep using your Shopee account.

How to apply for Shopee loan in the app?

To apply for a Shopee loan, you just have to wait for the SLoan feature to become available to you. Once, available, Shopee will offer you the maximum loan amount that you can borrow. You must first activate SLoan to proceed with the loan process.

Follow these steps to activate SLoan:

-

Go to the Shopee Dashboard and tap on Me and then SLoan.

-

The total maximum loan is displayed. Tap ‘Activate Now.’

-

Ener the One Time Password (OTP) or activation code.

-

Upload a valid Government-issued ID.

-

Fill out the application form.

-

You can provide additional information or perform additional tasks to get an additional credit limit:

-

Upload proof of residence (current utility bills)

-

Upload proof of income (current payslip)

-

Link to Facebook account

-

Undergo Liveness check through facial verification.

-

Wait for the approval. Once approved, you’ll receive a notification that your SLoan account has been activated.

-

You can now proceed with the loan.

Shopee customer care service

-

Shopee Customer Care Hotline: +63 2 88805200

-

Shopee Chat: You can activate the chat feature in the Shopee mobile app.

Shopee loan, reviews

Shopee loans through SLoan is a fast and easy way to get cash if you are a registered Shopee user. The credit facility has generally positive reviews for the quick application process. The downside is that you first have to establish Shopee activities before you become eligible. Also, the initial loan is much lower than the maximum loan that Shopee advertises. Overall, Shopee loan is something that’s fast and reliable if you are already a Shopee user, but not as quick if you’re a first-time user of the platform.

Have you used the Shopee loan? Share your experience here.