What is Tala?

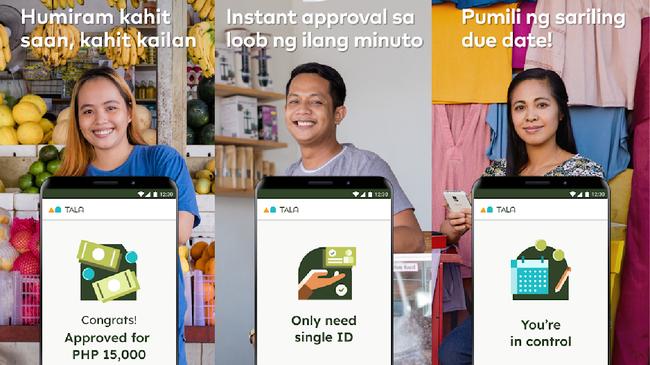

Many people struggle with paying their bills on time, which includes rent, utilities, credit card payments and other smaller expenses. Access to quick funds is not always available, especially in emergency situations. Luckily, online lending apps like Tala offers a way for Filipinos to borrow money fast without the need for collateral or credit check.

Tala Financing Philippines is one of the top instant cash loan providers in the country. Its parent company is based in Santa Monica, California and operates in India, Kenya, Mexico, and the Philippines.

Through the Tala mobile loan app, people have access to small loans to help buy necessities, pay down debt, pay tuition, or add capital to start a micro business. With low interest rates and reasonable payment terms, Tala is helping many Filipinos take charge of their financial situation.

How does Tala loan work?

The entire loan application process happens in the Tala loan app, which can be downloaded from the Google Play Store. Eligible applicants are asked to fill out an online form and answer some questions that will give Tala an idea of the financial capacity of the borrower. It may be a factor in determining the starting loan amount.

Upon approval of the loan, the funds are released to the applicants through any of these channels:

- Borrower’s bank account

- Padala Centers (Cebuana, Palawan, M Lhuillier)

- Coins.ph

Tala loan, how to apply?

Tala loan is designed to be inclusive, so there’s minimal requirement to be eligible:

- You must at least 18 years old.

- You must have a valid photo ID. Tala only accepts government-issued IDs (Passport, SSS ID, UMID, Postal ID, National ID, Voter’s ID, and driver’s license.)

- You must have an Android phone.

If you’re worried about having a bad credit score, you shouldn’t be. Credit history is not a requirement to get a loan from Tala. In fact, those who don’t qualify for bank loans are welcome to apply.

How much are Tala loans?

The starting loan amount with Tala is P1,000 and the maximum is P15,000. New borrowers are given a smaller amount for starters, but as they establish their capacity to pay and gain the trust of Tala, they can be given a higher loan amount on future cash loans.

Interest rates

The Effective Interest Rate (EIR) or the interest rate per month as well as the service fee will depend on the term of the loan:

- 15-day loans 17.46% EIR + 8.5% service fee + applicable taxes

- 30-day loans 15.92% EIR + 15.1% service fee + applicable taxes

- 61-day loans 14.87% EIR + 27.4% service fee + applicable taxes

Installments

Tala offers three installment options: 15, 30, and 61 days. Keep in mind that longer repayment terms carry higher interest rates. This is because the risk becomes greater for Tala to collect.

If you take on a longer repayment term, it could lead to high interest rates and high monthly payments over the course of your loan which makes paying it off very difficult.

Loan increase

Tala gives a smaller loan amount to new customers (i.e., P1,000-P2,000) for the initial loan application. A Tala loan increase is possible when customers establish that they are on time with payments and are not credit risks.

This means that if you have a good standing and pay your Tala loan installment payment on time, you can get the Tala maximum limit in the Philippines of P15,000 in your Tala 2nd loan mount.

How to pay my Tala loan?

You can pay your loan through Tala’s authorized payment channels:

-

GCash

-

Coins.ph

-

7-11

-

Cebuana Lhuillier

-

M Lhuillier

Tala customers are advised to pay their loans only through these channels, otherwise, payments will not be processed.

What happens if I don’t pay?

If you’re unable to pay your loan on time, you will be charged with an 8% penalty. So, it’s important that you settle your loan payment on or before the due date. Tala sends out reminders to make sure you don’t miss a payment.

If your Tala loan is not paid even after multiple reminders, Tala will endorse your account to one of their debt collections partners. Tala will also report you to the Credit Information Corporation (CIC) for delinquency. This will negatively affect your credit standing with Tala Philippines and impact your credit score.

If you find yourself short on cash, just share the Tala loan promo code or referral code to your friends and get P200 off your next loan payment for every qualified referral.

Tala loan to Gcash, is it possible?

At this time, GCash is not one of the options for receiving the loan. However, you can pay your Tala loan via GCash. You need a payment reference number which the Tala app will generate for you. You can easily repay your loans by making sure that your GCash account balance has enough funds.

Here are the steps for paying your Tala loan to GCash:

-

Using the app, sign in to your Tala loan login page.

-

On the Tala app home page, click on “Make a Payment.”

-

Enter the repayment amount. The payment due is displayed on top.

-

Choose “GCash” from the Payment Options.

-

The app will generate a payment reference number which includes the amount and the convenience fee.

-

Log in to your GCash mobile app.

-

Tap on “Pay Bills.”

-

Under Biller Categories, choose “Loans.”

-

Choose “Tala” from the options.

-

Enter the generated payment reference number in Step 5, your mobile number, amount, and e-mail address.

-

Once payment is done, you will receive a payment confirmation via SMS.

Is Tala legit?

Yes. Tala loan is legit. Tala is registered with the Securities and Exchange Commission and has been in operation since 2017. It has a Certificate of Authority to operate as a financing company in the Philippines.

Tala is one of the earliest and most recognizable mobile loan apps in the Philippines. It’s trusted by many customers who have availed of short-term loans using the Tala loan app.

Tala app

Google Play Store is the official Tala loan app download site. This means that the app only works on Android phones. Tala app is not available in the Apple App Store.

When you download an app from the Play Store, you're safe in knowing that it has been vetted by Google and is free from malware. However, when you use a Tala loan app download APK from an unknown source, you're taking a risk. Your device could be infected with malware, and you may not be able to uninstall the app without rooting your phone. So, using a Tala apps APK is not encouraged.

In terms of performance, the Tala app is easy to use. Its intuitive interface makes it easy to navigate the app and complete the Tala loan process. After you sign up, the app will ask you a few questions about your income and expenses. It then assigns you a loan amount based on the information you’ve provided.

- Download the Tala Loan app from the Google Play Store here.

Tala customer service

If you need to reach Tala’s customer support, the best way to do this is through the Tala app itself. You can either click the bell icon on the FAQ section of the app or click on “Submit a Request” which you can find on every article from the Help Center.

Other Tala Loan contacts:

- Email address: support@tala.ph

- Facebook: https://www.facebook.com/talaphilippines/

Tala reviews

The Tala loan app has been downloaded by millions of users in the Philippines, Mexico, India, and Kenya. It also has a rating of 4.7 stars, which is indicative of the quality of service provided by the company.

Most of the positive reviews pertain to Tala’s reasonable interest rates, Talon loan percentage, and service fees as well as flexible payment terms. Quick approvals and quick response of the customer support are also praised by many users of the app.

Some negative reviews refer to the limited number of banks for which to receive the approved funds. There were also complaints about the app not generating payment reference number, which causes a delay in payment.

Overall, Tala loan is a reliable online lending company that provides instant cash to Filipinos who need funds immediately.

Have you used the Tala loan app? Share your experience here.