What is Tonik Digital Bank, Inc?

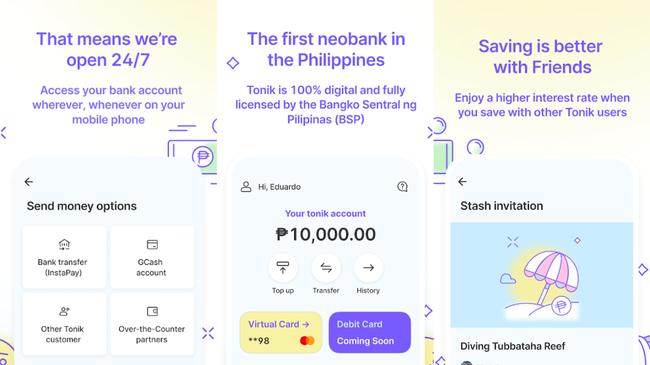

Tonik is the first digital-only bank in Southeast Asia, founded in 2018. In 2020, it launched as the first full-service neobank in the Philippines, offering financial products and services such as deposits, loans, investments, and insurance.

With the launch of Tonik’s Quick Loan product in 2021, Tonik entered the underserved consumer lending market, which will enable Filipinos to gain access to quick small loans online using the Quick Loan app. This helps bridge the gap between pay checks when an unexpected expense pops up. In short, these loans can provide much-needed financial relief in a pinch.

One of the biggest benefits of Tonik Quick Loan is that it’s typically much easier to obtain than traditional bank loans. You can often get approved for a loan in minutes, and you don't have to go through a credit check. This makes the service ideal for people with bad credit or no credit history at all.

Tonik Bank loan, how does it work?

Tonik Bank is a quick loan provider that can help you get the money you need in as little as 15 minutes. The application process is simple and takes just a few minutes to complete.

You only need to download the Tonik Quick Loan app, fill out the loan application form, and provide a valid ID. Once your application is approved, you can have the money you need in your bank account in minutes.

How much does Tonik Bank loans?

Typically, how much you can borrow depends on a number of factors, including your credit score, but with Tonik Bank, you can borrow anywhere from P5,000 to P50,000 even if you have poor credit.

Tonik offers flexible terms that can be tailored to your needs. You can choose installment periods of 6, 9, 12, 18, or 24 months. This allows you to spread the payments over several months so that they’re more manageable and more convenient. If you're in need of some fast cash, Tonik Bank loans may be a good option for you.

Interest rates

The Tonik Bank Philippines interest rate is 7% per month (or Annual Percentage Rate of 84%). On the other hand, the interest rate for loans with linked card is 5.416% (APR 65%). Tonik offers fixed interest rate regardless of the loan term.

Is Tonik Bank safe? Is it legit?

Yes, Tonik Bank is legit. It was incorporated on May 26, 2020, as Tonik Digital Bank, Inc. It received a Certificate of Authority to Operate from the Bangko Sentral ng Pilipinas on September 3, 2020. Tonik launched its commercial operations on November 25, 2020. The Tonik Quick Loan app was launched in 2021.

Is It SEC Registered?

Yes. Tonik Digital Bank was registered with the Securities and Exchange Commission in May 2020 to extend banking services to underserved agricultural and industrial enterprises, particularly small and medium scale enterprises. With the launch of the Quick Loan app, Tonik expands its reach to offer small personal loans to individuals who need them.

How long does it take to have the money?

Tonik quick cash loans are a fast and easy way to get the money you need. Once you are approved, the money will be deposited into your account within minutes. Of course, this will depend on the day and time of approval and how fast your bank processes the transaction.

How to apply for a loan?

Just follow the next steps to get a loan with Tonki Bank:

- Download the Tonik Quick Loan app.

- Fill out the loan application form with your personal information.

- Provide a valid ID.

- Wait for a few minutes while your application is approved.

- Wait for the money to arrive in your bank account.

Requirements

To qualify for a Tonik Bank quick loan, you must meet the following requirements:

-

You must be at least 23 years old and no older than 58 years old.

-

You must be currently employed or have a stable source of income.

-

You must have a government-issued ID and a Tax Identification Number (TIN).

-

You must have a valid bank account.

Additional requirements If you want to apply for a loan with a linked card:

-

You must have your latest pay slip or full month salary bank statement.

-

You must have a Tonik PH savings account.

-

You must have a salary ATM payroll card.

How do I pay the loan?

You can repay your loan through mobile banking, bank deposit, bank transfer, or Tonik’s authorized payment channels.

What happens if I can't pay?

If you miss payments, you may be charged late payment fee and other related fees. It may also result in increased interest rates. This can make paying the loan amount even more difficult.

If you default on your payment, Tonik may take legal action as a last resort. Make sure that you only borrow the amount you can pay religiously and conveniently.

Tonik Bank app

The Tonik Bank app is available for Android and iOS devices. You can download the app from the Google Play store and the Apple App Store. The app is easy to use with intuitive interface. It also has security features like Face ID to secure the app and prevent it from unauthorized access.

Tonik Bank Philippines, customer service

Phone number: +63 2 5322 2645

Email address: customercare@tonikbank.com

Tonik Bank Philippines website: https://tonikbank.com/

Tonik Bank complaints

Tonik is one of the latest banks to offer quick loans, but it’s already receiving complaints from customers. Many people are unhappy with the high interest rates and fees that Tonik charges. In addition, some customers say that the loan process was not as easy as advertised. It has similar requirements to traditional banks and small lending companies.

Tonik Bank reviews

Tonik Bank reviews are generally positive, with an average rating of 4.5 stars on the Google Play Store and 4.3 on the App Store. However, the exorbitant interest rates have been a major source of frustration for borrowers. Tonik also requires more documents than similar online lending platforms, which makes it difficult for some people to get approved for loans.

Have you used Tonik Bank loans? Share your experience here.