What is UnaCash?

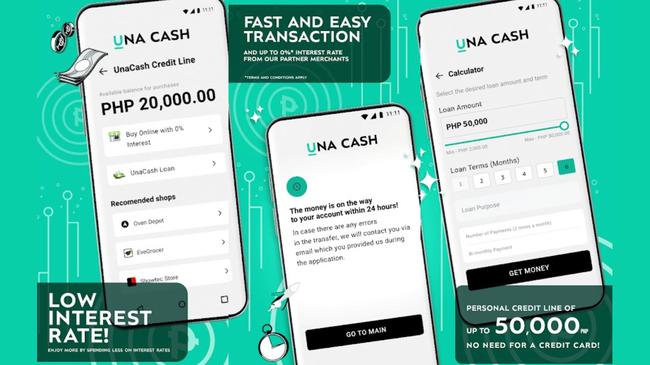

In the approach of almost everything being digitized, the financial industry has been keeping its phase with innovation. Introducing UnaCash, under Digido Finance Corp., a lending company known in the market as an all-digital cash loan application that provides solutions to the financial problems of Filipinos.

UnaCash is accessible any time of the day, you just need a phone and an internet connection. The online application promotes borrowing money with the lowest interest rates, in a convenient and seamless way at the comfort of your own home.

How does UnaCash work?

Since UnaCash works on the digital platform, you can access the company through its official website, https://unacash.com.ph/ , or download its mobile application, whichever works best for you. Just make sure you have a mobile phone and a good internet connection, then you can now proceed to the loan application.

UnaCash is pure mobile banking, meaning there is no need to visit the physical branch and do over-the-counter transactions, what’s more, enticing is that the loan application process is fast and can be done in just a matter of hours, it can be completed with just 4 easy steps, and has a favorable repayment term.

How can I apply for a loan with UnaCash?

Just like any other online lending solution in the Philippines, when applying for a loan with UnaCash, you will usually undergo a 4-step procedure to successfully process your loan application.

Here are the 4 steps you need to accomplish to acquire a loan with UnaCash:

- Fill in your personal information (Full name, email address, date of birth, etc.)

- Select the loan terms (Including the loan amount and period of repayment)

- Wait for the loan approval (The process usually takes less than 24 hours)

- Get your money (After the loan approval, you can now access your loan money)

Requirements

-

Must be a Filipino citizen

-

Age 18 years old and above

-

A valid e-mail address and mobile number

-

Any government-issued ID

-

Employed with stable income (optional, but can increase loan approval)

How much are UnaCash loans?

UnaCash offers a wide range of opportunities to qualified Filipino loan applicants. You can borrow up to a maximum of Php 50,000. Take note that the approved amount will be based on your credit score as well as the interest rates. For starters, it is advisable to borrow money that is within your reach. Avoid borrowing an excessive amount of money, this way you can avoid default payment and penalties.

Interest Rates

-

The interest rate ranges from 3% up to 10% per month depending on the credit score of the client

You can check out UnaCash’s online calculator to view the monthly repayment amount.

UnaCash Loan Repayment

Maintaining the company’s motto of promoting fast and convenient borrowing, the same method applies to its loan repayments. A client is required to make loan repayments twice (2) a month. UnaCash offers a flexible repayment term, ranging from 1 to 6 months (30 days up to 180 days).

Online Payment

Some of the authorized online payment channels are the following:

-

GCash

-

Online bank transfers (PNB and RCBC)

Where can I pay the loan?

Aside from paying online, you can also visit UnaCash authorized physical partners:

-

7-Eleven

-

The SM Store

-

M Lhuillier

-

Cebuana Lhuillier

-

Bayad Center

You have numerous options to choose from to make repayments. Make sure to pay on or ahead of time to avoid penalties and additional charges.

Is UnaCash legit?

Being a company under the management of Digido Finance Corp. it sure has earned the public’s trust. Aside from that, the company takes measures to abide by the laws regulated by the SEC (Securities and Exchange Commission) to be able to operate legally in the Philippines.

UnaCash’s SEC Registration number is CS202003056, and the company’s Certificate of Authority number is 1272. The anniversary or founding date of UnaCash is on March 4, 2020. The above information proves the legitimacy of the company, making your information safe and secure.

UnaCash Application

Having said that UnaCash is an all-digital financial solution, it is a given that the company offers a mobile application that can be downloaded here: https://play.google.com/store/apps/details?id=com.robofinance.unacash .

Make sure to read first the terms and conditions before applying for a loan, to prepare yourself for the huge responsibility of making repayments after the loan has been approved.

UnaCash Customer Service

UnaCash has developed its customer service hotlines for its clients to easily voice out their concerns and be addressed immediately. You may reach them through the following:

Phone Number

-

Unfortunately, UnaCash doesn’t have an official phone number

E-mail Address

- care@unacash.com.ph You can still reach them with the e-mail address provided above for any concerns and queries.

UnaCash Complaints

When it comes to handling concerns, it is a must that every company, like UnaCash should establish a strong customer service team for fast action on the issue. To start, here are some of the complaints UnaCash received from their valued clients. These complaints can be their head start as to what actions to improve.

-

Clients are having disbursement issues, the information on the application and the customer representative is not in sync. The client waited for almost 3 days but still, nothing happened to the loan money.

-

Good payer clients are disappointed because they cannot apply for a repeat loan due to some bugs in the application.

-

The customer representative keeps on calling saying the client still needs to pay for the repayment, even though the client already does so.

-

Some clients are disappointed about the rude/unpleasant customer service.

UnaCash Reviews

Through clients’ reviews, companies like UnaCash can assess where aspects of the business should be improved to serve their clients better. Here are some of the client’s reviews in doing transactions with UnaCash.

In a review site called All the Best Loan, UnaCash received a 5/5 rating, meaning the clients had a pleasant experience using UnaCash financial services.

In the Google Play Store reviews, the application only received a 3.5/5 rating. Though it is just above average, one client said that she is thankful for UnaCash because their service helped her in times of financial crisis. Good and bad reviews are part of the business, what’s important is to keep moving forward and improving their services.