What is Zippeso Fintech?

Zippeso Fintech is one of the most convenient lending company in the Philippines. It is an online lending company that offers a wide range of loans. This company has helped many people who are not familiar with lending, and has given them the opportunity to borrow a loan with no collateral. It has had a great success rate and has caused people to want to come back for more.

Zippeso gives you access to the most convenient way to finance your enterprise, personal, or household needs. Zippeso Fintech is also a convenient way to pay for your bills, pay for your expenses and make a deposit for your account. Indeed, Zippeso Fintech has a variety of ways for you to finance your needs, whether it is for your business or personal life.

Zippeso Loan App, how does it work?

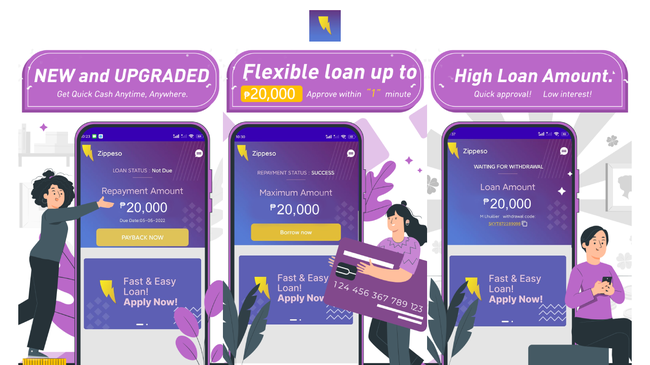

Zippeso is a mobile app that allows Filipinos to borrow PHP 2,000 up to PHP 20,000 at 20% interest rate. The application is available for both iOS and android devices and is available for download on Google Play Store and App Store. The loan is for a period of up to 12 months and the interest rates are competitive (but higher than the average APR in banks) as compared to other lending products.

Interest rate

The available interest rate on Zippeso is 20% - this is considered higher than the average APR. However, the company doesn’t charge any transaction fees which makes it better than other lending apps available in the country.

Is Zippeso legit?

Yes, Zippeso is legit and is available to download on your mobile. You can also visit this link to view the app on Google Play Store.

How much is the Zippeso loan?

Zippeso Fintech allows borrowers to loan money from PHP 2,000 up to PHP 20,000 – this is a perfect opportunity to cover short-term needs or get out of a financial bind.

Is Zippeso SEC registered?

Yes, Zippeso is resgitered with Securities and Exchange Commission with Registration NO.CS201916340 and CA NO.3101.

Zippeso loan app benefits

Filipinos are increasingly embracing the "payday loan" industry, but new data from the National Credit Counseling for Education and Rehabilitation Inc. (NCCER) shows that over half of all borrowers do not fully understand the risks associated with such loans. Zippeso Fintech is changing that by letting Filipinos borrow money for short-term needs without the risk of over-borrowing.

Zippeso is a loan app, where you can borrow money for short-term needs. One of the benefits of this app is that it is very easy to get approved for a loan, and you don't need to have a stable income or even a great credit score.

Another benefit is that you don't have to have a checking or savings account to use the app. This is very beneficial for Filipinos who are entering the workforce and might not have the money to put towards a checking account. Another benefit of Zippeso is that the money you borrow is available in just a few hours. This is especially useful for people in need of quick cash.

Zippeso loan, how to apply?

To start with your application, you can just download the app on your phones then fill out an application form to successfully register and create an account. Once done, submit a Valid ID but make sure that it’s government-issued. Wait for the company’s approval in regards to your loan.

Requirements

If you want to be eligible with Zippeso, you must be/have:

-

Filipino citizens

-

18 - 60 years’ old

-

ONE government-issued ID

-

Stable Income

Zippeso loan, how to pay?

To pay for Zippeso loan, just go to the nearest 7/11, or pawnshop such as M. Lhuillier, Cebuana Lhuillier, etc. You can also pay through e-wallets like Gcash, Grabpay and Maya. Zippeso also accepts payments through banks like BPI, Metrobank, and BDO.

What happens if you can't pay?

The consequences of you not paying the loan is many. Including higher late payment fees and other hefty charges. There’s also a possibility that you won’t be able to get a loan from Zippeso again.

Zippeso Loan App

The Zippeso Loan App is a mobile app that allows consumers to access the best possible loans from the comfort of their homes. The app is available in the Philippines and is available for both iPhone and Android users. Zippeso has a loan application process that is quick and easy for the Filipino consumer. The application process will take less than ten minutes to complete and it can be done through the app or through their website.

App download

To download the app, simply go to Google Play Store or App Store. If you prefer APK, go to this link to get started.

Zippeso, customer service

If you have any concerns, questions, or problems with your Zippeso loan, feel free to get in touch through the following contact information:

Hotline

- 09668651730 or 09158083137 (Monday - Sunday 9am - 6pm)

- zippesocs@gmail.com

Address

- L29 Joy Nostalg Centre, 17 ADB Avenue, Ortigas Center, Brgy. San Antonio 1602 Pasig City, Philippines

Zippeso Loan App, complaints

Some complaints received by Zippeso is about their application process which can take days or weeks to complete. This is not helpful especially to people who need the money for emergency purposes.

Zippeso Loan App, reviews

Financial technology startups are rapidly expanding in the Philippines as consumers are embracing innovative technologies. Zippeso, a fintech company, has released their loan app in the Philippines. The loan app is available for residents in the Philippines, who are looking for a new way to borrow with a flexible loan. Many consumers are rating Zippeso with positive reviews and some people are even recommending it.

Have you used the Zippeso loan app? Share your experience here.